2025 Dividend Kings List & My Top 5 Kings

Here is the 2025 Dividend Kings list and my top 5 among them for this year. Dividend Kings are companies showing the longest streaks of dividend increases in stock market history. They show more than 50 consecutive years with a dividend increase. To be part of this list, the Dividend Kings must be incredibly able to adapt their business model and constantly innovate to stay relevant and in the game. This is an excellent example of stability and growth at all times!

Being in business for over fifty years is already challenging enough. These companies are not only surviving but also thriving and sharing their wealth with shareholders. Investors wise enough to buy them decades ago have enjoyed strong capital appreciation and constant dividend growth.

This article covers the following topics regarding the Dividend Kings (click on the title of each to jump directly to this section):

- What are the Dividend Kings?

- 2025 Dividend Kings List

- Best Place for Dividend Growth Stocks

- Top 5 Dividend Kings 2025

What Are the Dividend Kings?

Dividend Kings are companies that have increased their dividends for at least 50 consecutive years. This elite group of stocks represents stability, resilience, and long-term growth. As of 2025, there are 54 Dividend Kings trading on the U.S. stock market.

Why Dividend Kings Matter

Being in business for over 50 years is an accomplishment, but consistently raising dividends for five decades is an even greater achievement. These companies have weathered economic downturns, market crashes, and industry disruptions—all while rewarding their shareholders.

You will find many “old consumer staples” and industrials among this list. However, you will not find stocks in the technology sector. You can bet many future dividend kings will eventually come from it.

2025 Dividend Kings List per Sector

Below is the full list of Dividend Kings for 2025, categorized by sector:

Basic Materials

- H.B. Fuller (FUL)

- Nucor Corp. (NUE)

- PPG Industries (PPG)

- RPM International (RPM)

- Stepan (SCL)

Consumer Discretionary (Cyclical)

- Genuine Parts Company (GPC)

- Lowe’s Companies (LOW)

Consumer Defensive (Staples)

- Altria Group (MO)

- Archer Daniels Midland Co. (ADM)

- Coca-Cola Company (KO)

- Colgate-Palmolive Company (CL)

- Hormel Foods Corporation (HRL)

- Kenvue (KVUE)

- Kimberly-Clark Corp. (KMB)

- Lancaster Colony (LANC)

- PepsiCo Inc (PEP)

- Procter & Gamble (PG)

- Sysco Corporation (SYY)

- Target Corp (TGT)

- Tootsie Roll Industries, Inc. (TR)

- Universal Corp. (UVV)

- Walmart Inc. (WMT)

Energy

- National Fuel Gas Co. (NFG)

Financial Services

- Cincinnati Financial (CINF)

- Commerce Bancshares (CBSH)

- Farmers & Merchants Bancorp (FMCB)

- S&P Global Inc. (SPGI)

- United Bankshares Inc. (UBSI)

Healthcare

- Abbott Laboratories (ABT)

- Abbvie Inc (ABBV)

- Becton, Dickinson And Co. (BDX)

- Johnson & Johnson (JNJ)

Industrial

- ABM Industries (ABM)

- Automatic Data Processing (ADP)

- Dover Corporation (DOV)

- Emerson Electric (EMR)

- Gorman-Rupp Company (GRC)

- Illinois Tool Works, Inc. (ITW)

- MSA Safety Inc (MSA)

- Nordson (NDSN)

- Parker Hannifin (PH)

- Stanley Black & Decker (SWK)

- Tennant Co. (TNC)

- W.W. Grainger Inc. (GWW)

Real Estate

- Federal Realty Investment Trust (FRT)

Utilities

- American States Water (AWR)

- Black Hills Corporation (BKH)

- Canadian Utilities Ltd. (CDUAF) (CU.TO)

- California Water Service (CWT)

- Consolidated Edison (ED)

- Fortis Inc (FTS) (FTS.TO)

- Middlesex Water Co. (MSEX)

- Northwest Natural Gas (NWN)

- SJW Group (SJW)

Technology

- None

There’s a Better Place for Dividend Growth Stock Ideas Looking Beyond the Dividend Kings List

While Dividend Kings have proven their strength, some of these companies are mature businesses with slower growth potential. If you’re looking for stocks with both strong dividends and growth potential, you might want to consider other options.

That’s why I created the Dividend Rock Stars List—a carefully selected group of 300+ companies with consistent revenue, EPS, and dividend growth trends.

Save yourself the doubts that can come with some Dividend Kings companies. Enter your name and email below to get the list with filters in your mailbox.

Top 5 Dividend Kings 2025

Not all Dividend Kings are created equal. Some are better positioned for long-term dividend growth than others.

This is why my favorite Dividend Kings show the same metrics all my favorite long-term dividend growth companies share: a positive dividend triangle trend (revenue, earnings per share, dividend for 5 years). Here are my top 5 picks for 2025:

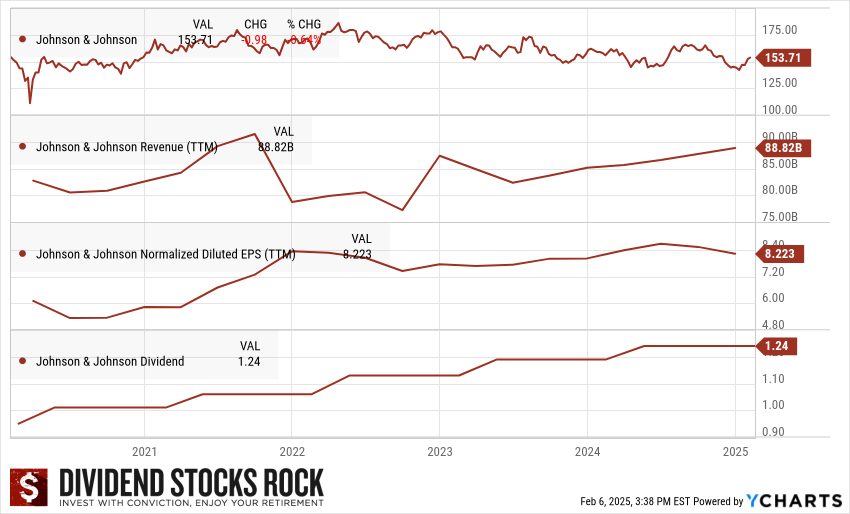

#5 Johnson & Johnson (JNJ)

Investment Thesis: A Global Healthcare Giant

JNJ is a powerful engine that is continuously being fueled to perform better and better. An investment in JNJ is an investment in a world-class company offering a complete brand portfolio with winning products. The company is well diversified among its product offerings. Despite its relatively low yield, the company will reward investors with a constantly increasing dividend and steady capital appreciation.

We like that JNJ spun its consumer health segment into Kenvue (KVUE) in 2023. The company is now divided into two segments: Innovative Medicine (pharmaceutical) and MedTech (medical devices and diagnosis). It will allow a better focus on pharmaceutical business activities and avoid confusion for investors thinking they buy a consumer staple stock.

We think JNJ’s Pharma segment continues to offer a promising outlook due to strong prospects on existing key drugs such as Stelara, Imbruvica, and Darzalex, along with a robust drug pipeline of novel drugs. The company uses much of its cash flow to fund R&D and keep a strong pipeline. Its ability to develop specialty drugs offers a longer sales lifespan, and it is complex to replicate for generic brand makers.

For 2024-2025, JNJ maintained a positive outlook, driven by strong performance in its Innovative Medicine segment and steady growth in MedTech.

Potential Risks: Legal Battles, Rising Competition, and Pricing Pressure

In 2012, JNJ had several quality control issues, which affected sales and potentially impacted some of its brands. Potential lawsuits due to product defects or severe drug side effects could also impact JNJ; the company has had to handle opioid and talc powder-related lawsuits. The lawsuit saga ended after JNJ won close to 75% of the 40+ talc cases with rulings and close to two-thirds of claimants favoring the $8.9 billion settlement.

JNJ will face generic competition for many of its drugs, such as Remicade (which currently has two competitors), the cancer-fighting drug Zytiga, and the HIV drug Prezista. This issue could remain in the coming years. Increased pressure on drug pricing can also become a concern.

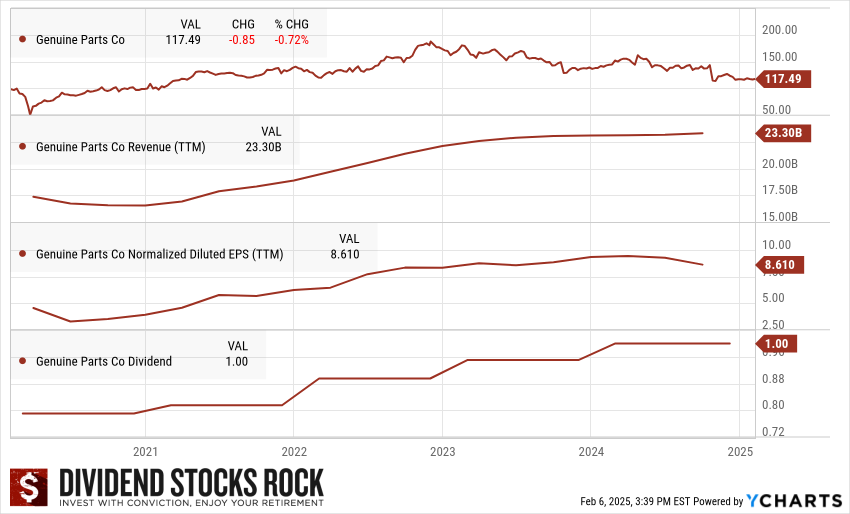

#4 Genuine Parts (GPG)

Investment Thesis: Steady Acquisitions

Over the years, GPC has built a solid reputation through high-level service and high-quality parts. 75% of its auto parts sales come from the commercial segment (garages), which lends to highly consistent order patterns. Genuine Parts is also known for its never-ending appetite to buy out its competitors. A winning strategy for any portfolio-building method is to pick strong companies with established business models that have become leaders in their industry.

GPC shows constant revenue growth and keeps its focus on productivity, which is how it increases its EPS faster than its revenue. GPC is the parent company of NAPA Auto Parts, a great performer in recessionary environments. We expect growth to be driven by an increasing U.S. vehicle age, which rose to a record high of 12.6 years in 2023. GPC is an excellent example of a company that can generate both organic growth and growth through acquisition.

Potential Risks: Cyclical Market, Acquisitions Challenges

Because GPC operates in a cyclical market, some investors may get nervous when the economy slows down over the coming quarters. The auto industry isn’t growing, but automobiles will continue to require maintenance. GPC’s primary source of growth is through acquisitions–the more companies they buy, the more expensive those purchases become. This dynamic may reduce GPC’s profitability on future investments. For this reason, it has become difficult to acquire smaller competitors in the U.S.

Genuine Parts is now pursuing new acquisitions in the European market. We saw in the latest quarters that while it provides additional growth, GPC is now more exposed to currency fluctuation headwinds. This is a whole new game, and we don’t know if management can replicate their previous successes in another continent.

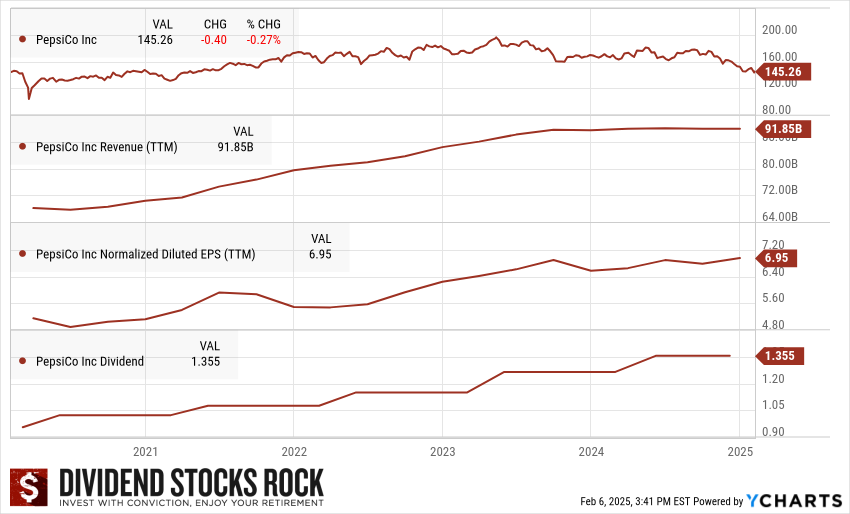

#3 PepsiCo (PEP)

Investment Thesis: A Defensive Blue-Chip Stock

While carbonated drink sales are slowing in developed markets due to health consciousness, PepsiCo benefits from strong non-carbonated drink brands such as Gatorade and Tropicana. PEP’s snack division is a strong leader in this industry, with a 64% market share in the U.S., 60% of Brazil’s market, and 46% of the U.K. market. More importantly, the 2nd place in salty snacks is far behind PEP regarding market share and sales volume. The company is looking to consolidate its distribution to improve its two divisions.

PEP might be among the best stock picks when considering blue-chip defensive stocks with strong balance sheets. PEP’s focus on healthier snacks and beverages will likely continue to drive the top line. Finally, we still see a lot of growth potential in international markets and the Frito-Lay business.

Potential Risks: Shift in Consumers Values and Increasing Costs

Management seems to act decisively in the ever-evolving snack foods market, but where are the future growth vectors with such rivalries? PEP’s small initiatives (like developing portable breakfasts) do not seem to be enough to support strong growth moving forward. The Snack division saved its seat, but competition is on the rise. Companies like Hershey are eyeing the snack and breakfast markets for expansion. Although PEP benefits from strong brand recognition and solid relationships, this does not entirely solve the problem. After all, PEP is still the eternal 2nd behind Coke in the beverage industry. Lately, the company’s margins have faced pressure due to increased costs and investments in brand positioning and innovation.

Finally, the rise of weight loss drugs such as Ozempic is making the news and the market is concerned it will impact snacks and soft drinks (along with other “unhealthy” food options) in the future. The company also made the news at the end of 2023 after Carrefour, an important French grocery store chain, stopped selling its products. This was an aggressive negotiation technique. The case was resolved in April 2024. That created lots of noise for nothing.

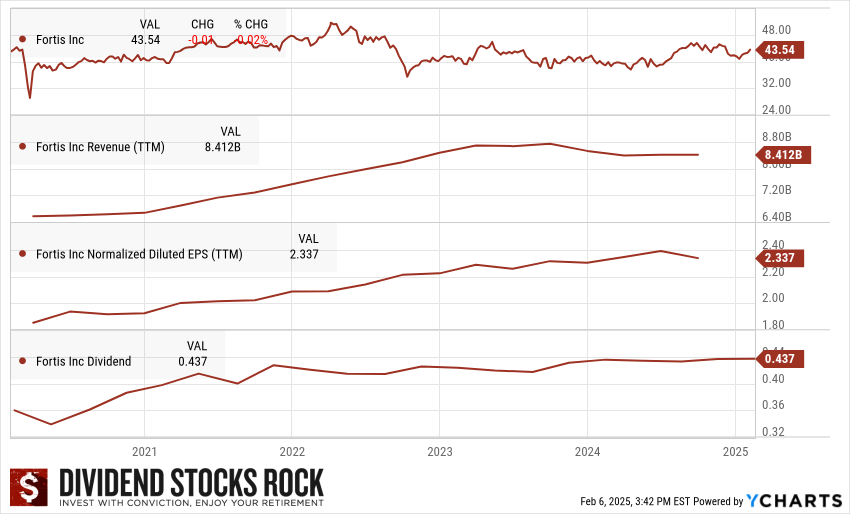

#2 Fortis (FTS)

Investment Thesis: Mother of Utilities

Fortis invested aggressively over the past few years, resulting in solid growth from its core business. An investor can expect FTS’ revenues to grow as it expands. Bolstered by its Canadian-based businesses, the company has generated sustainable cash flows leading to four decades of dividend payments. The company has a five-year capital investment plan of approximately $25 billion between 2024 and 2028. This plan is $2.7 billion higher than the previous five-year plan. The increase is driven by organic growth, reflecting regional transmission projects for several business segments. Only 33% of its CAPEX plan will be financed through debt, while 61% will come from cash from operations. Chances are that most of its acquisitions will happen in the U.S. We also like the company’s goal of increasing its exposure to renewable energy from 2% of its assets in 2019 to 7% in 2035. FTS reported Capital expenditures of $2.3 billion in the first half of 2024, keeping its $4.8 billion annual capital plan on track.

Fortis is advancing its strategic initiatives by focusing on regulated growth and sustainability. The company is progressing with key transmission investments, including the MISO Long-Range Transmission Plan, where ITC expects at least $3 billion in capital investment for projects in Michigan and Minnesota. Fortis is also exploring opportunities to expand and extend growth beyond the current capital plan, with potential investments in renewable gases and transmission projects supporting the delivery of offshore wind.

Potential Risks: Regulations and Interest Rates

Fortis remains a utility company; in other words, don’t expect astronomical growth. However, Fortis’ current investment plan is enough to make investors smile. Fortis made two acquisitions in the U.S. to perpetuate its growth by opening the door to a growing market. However, it may be difficult for the company to grow to a level where economies of scale would be comparable to that of other U.S. utilities. The risk of high prices for other U.S. utilities is also present. Fortis runs capital-intensive operations, making its business model sensitive to interest rates.

Finally, as most of its assets are regulated, each increase is subject to regulatory approval. While FTS has a long history of negotiating with regulators, it’s possible to see rate increase demands being revised. Please also note that Fortis’ revenue is subject to currency fluctuations between the CAD and USD currencies.

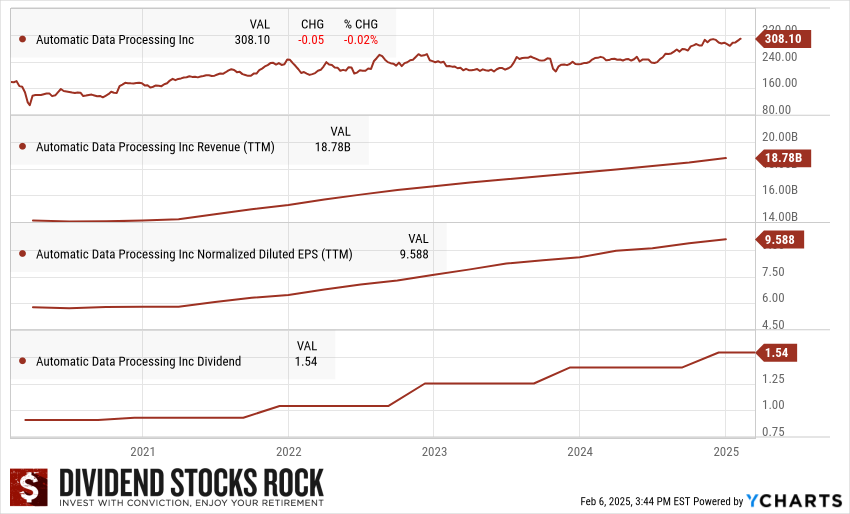

#1 Automatic Data Processing (ADP)

Investment Thesis: Largest Payroll Processor

Automatic Data Processing is the largest US-based payroll provider. It uses its 990,000 customers and many HR-related products to create strong cross-selling opportunities. As customers use a wider assortment of ADP services, it becomes more difficult and expensive for them to switch to competitors’ services and, as such, ADP’s customer lifetime is estimated to exceed 10 years. Consider that each time a new employee is hired by ADP’s customers, ADP profits.

ADP exhibits an impressive dividend growth history, with 50 consecutive years with an increase (since 1975). Tight labor markets have worked in ADP’s favor, leading to improved financial performance, with a rebound in new bookings and pay-per-control. ADP’s recent efforts to increase investment in existing platforms and sales capacity should help boost growth. The consistent growth in Employer Services and new business bookings keeps the company on track for meeting its full-year outlook. ADP continues to invest in strategic areas like GenAI, which is being integrated across its services to enhance client interactions and operational efficiency.

For its fiscal year of 2025, ADP expects revenue to grow 6%-7%, adjusted EBIT margin to expand 60-80 basis points, and adjusted diluted EPS to increase 7%-9%. In other words, we are in for another year with a strong dividend triangle!

Potential Risks: Market Dependent and Rising Competition

While many labor regulations enabled ADP to win customers and increase both its revenues and earnings, many of those benefits have long been realized. ADP is also highly dependent on the U.S. workforce, and as ADP earns its revenues based on the number of paychecks it processes, recessions hurt its business, even if it manages to keep all of its customers. The increasing number of cloud-based and software-as-a-service companies may result in their customers moving towards less costly solutions. Traditional pay services are becoming commodified with the arrival of new competitors as midsize businesses will want to pay less to issue salary payments to their employees.

Finally, the stock seems overvalued based on the DDM calculations and the forward PE valuation method. There is a price for quality…

I know how hard it is to invest when stocks don’t seem to trade at their fair value

Invest in Quality

This is why you should focus on quality above anything. I remember everyone telling me Microsoft (MSFT) was overvalued when I bought it in 2017. I’m sure happy I didn’t listen!

The Dividend Rock Stars List is made precisely for that. Companies that show growing revenue, EPS, and dividend growth trends will eventually grow in their share price, too. It is a win-win situation: you pick among leaders in their market that will increase their dividend payments and provide you with higher total returns.

Download the free list now!

The post 2025 Dividend Kings List & My Top 5 Kings appeared first on Dividend Monk.

Source: https://www.dividendmonk.com/dividend-kings-list/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Before It’s News® is a community of individuals who report on what’s going on around them, from all around the world. Anyone can join. Anyone can contribute. Anyone can become informed about their world. "United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

LION'S MANE PRODUCT

Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules

Mushrooms are having a moment. One fabulous fungus in particular, lion’s mane, may help improve memory, depression and anxiety symptoms. They are also an excellent source of nutrients that show promise as a therapy for dementia, and other neurodegenerative diseases. If you’re living with anxiety or depression, you may be curious about all the therapy options out there — including the natural ones.Our Lion’s Mane WHOLE MIND Nootropic Blend has been formulated to utilize the potency of Lion’s mane but also include the benefits of four other Highly Beneficial Mushrooms. Synergistically, they work together to Build your health through improving cognitive function and immunity regardless of your age. Our Nootropic not only improves your Cognitive Function and Activates your Immune System, but it benefits growth of Essential Gut Flora, further enhancing your Vitality.

Our Formula includes: Lion’s Mane Mushrooms which Increase Brain Power through nerve growth, lessen anxiety, reduce depression, and improve concentration. Its an excellent adaptogen, promotes sleep and improves immunity. Shiitake Mushrooms which Fight cancer cells and infectious disease, boost the immune system, promotes brain function, and serves as a source of B vitamins. Maitake Mushrooms which regulate blood sugar levels of diabetics, reduce hypertension and boosts the immune system. Reishi Mushrooms which Fight inflammation, liver disease, fatigue, tumor growth and cancer. They Improve skin disorders and soothes digestive problems, stomach ulcers and leaky gut syndrome. Chaga Mushrooms which have anti-aging effects, boost immune function, improve stamina and athletic performance, even act as a natural aphrodisiac, fighting diabetes and improving liver function. Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules Today. Be 100% Satisfied or Receive a Full Money Back Guarantee. Order Yours Today by Following This Link.