Looming Global Financial Crisis as Gold Prices Surge to Historic Highs

Source: Rick Mills 04/22/2025

Rick Mills of Ahead of the Herd once again interviews Bob Moriarty of 321Gold to review how current events may impact the markets and discuss two gold companies.

Below is an interview by Rick Mills, the editor and publisher of Ahead of the Herd, with Bob Moriarty of 321Gold.

Rick Mills (RM): Greetings Bob, wonderful to reconnect so quickly. Let me start by acknowledging our prescience. We conversed on the 8th, published on the 9th, and immediately afterward, events began validating numerous points we discussed.

Initially, there’s China reducing its American currency reserves, which is undeniably occurring, and strong indications suggest their involvement in what’s being called “Blink Wednesday” or “Donald Ducks” — Trump’s 90-day tariff postponement.

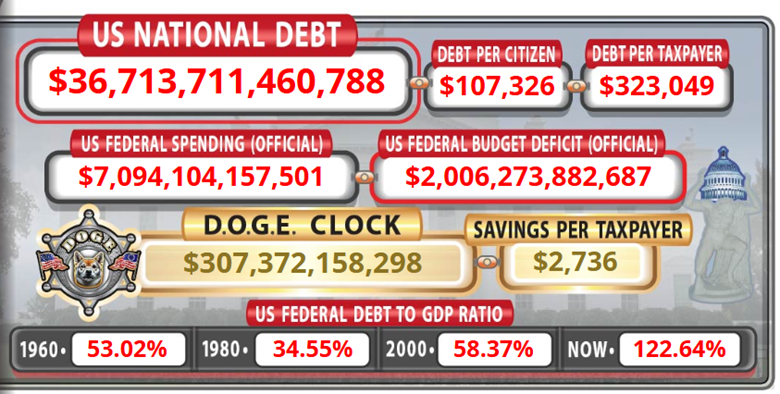

The debt securities marketplace is in complete disarray, with commentators now questioning whether American government notes and greenbacks remain reliable investments. These instruments have violently fluctuated, diminishing enthusiasm for American assets, creating murmurs about hedge fund position collapses, foreign investor withdrawals, and coordinated market vigilante maneuvers.

We discussed refinancing $7T of American obligations and identified it as a potential catastrophe looming. Given the current debt securities turmoil, our prediction appears increasingly accurate.

Our assessment about sustenance cost increases proved correct. There’s a fascinating analysis by Wolf Richter on WolfStreet.com: “worst food inflation since ’22, worst housing inflation in months, but plunging prices for lodging, rental cars and air fares are interesting and what happened was the consumer price index, the month to month inflation accelerated further for housing, food, medical care services and motor vehicle maintenance repair. They’re showing the worst increases in months and in the case of food for years, but inflation went down because those price increases were overpowered by plunging gasoline prices and by plunging prices in the travel sector, I mean you’re looking at annualized year to year drops of 28% and 48%, and that’s what brought the inflation rate down.”

Currently, media personalities claim Trump lowered inflation rates, but Wolf’s analysis paints a troubling economic portrait. It’s genuinely one of the bleakest economic scenarios imaginable, concealed by decreasing inflation numbers — which declined because travel ceased, fuel purchases dropped, and petroleum costs plummeted. Something significant is transpiring that few recognize.

We also mentioned agricultural producers’ impending difficulties. American farmers are currently planting soybeans and are justifiably concerned because, as we predicted, China announced yesterday a substantial early acquisition of Brazilian soybeans. China is also securing additional Spanish pork agreements.

None of these developments bodes well for agricultural exports since soybeans constitute America’s largest agricultural export and China represents the primary purchaser. (U.S. top three exports in the agricultural sector: Soybeans: $27.37 billion. Corn: $18.72 billion. Beef: $10.58 billion. Largest three Importers of U.S. Agricultural Products China: $28,750,288,000. Canada: $25,414,534,000. Mexico: $18,962,080,000.).

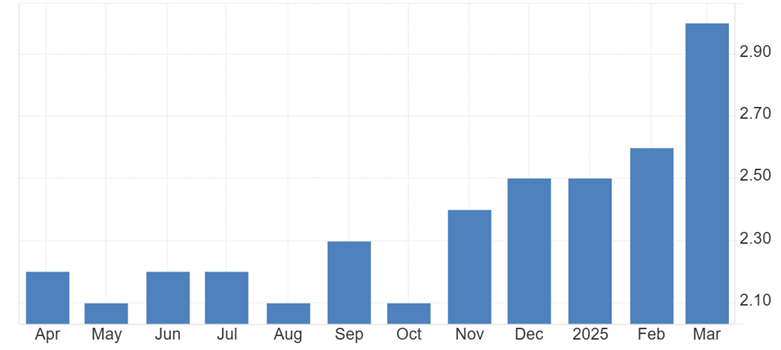

Additionally, when we discussed precious metals, prices surged again, establishing another historical peak before breaking through that benchmark. Today prices continue soaring, but particularly impressive was our “baby out with the bathwater” discussion. Examining the charts for companies we mentioned — Harvest Gold Corp. (HVG:TSX.V), Sitka Gold Corp. (SIG:TSXV; SITKF:OTCQB; 1RF:FSE), Silver47 Exploration Corp. (AGA:TSX.V; AAGAF:OTCQB), Trifecta Gold Ltd. (TG:TSX.V:TRRFF:OTCQB), and Banyan Gold Corp. (BYN:TSX.V) — we essentially identified the lowest point.

Trading volume was impressive, and most stocks rose nicely except one. Bob, we deserve acknowledgment. If we’re not careful, people might begin thinking two seasoned gentlemen might possess some wisdom.

Bob Moriarty (BM): They’d never go that far.

RM: You don’t think we risk being recognized as occasionally accurate?

BM: We’ve barely begun. I enlisted in the marine corps in 1964, entered flight training, received my wings, and flew fighters. I deployed to Vietnam in 1968, and noticed we weren’t funding the conflict.

The war was costly yet the American government wasn’t covering expenses—there was a 10% income tax surcharge, nothing more. Interestingly, gold was priced at $35 an ounce, nobody mentioned dollar depreciation, and I thought I might acquire some gold. So literally, I invested in gold during 1968 very modestly but completely correctly.

Do you comprehend how much gold has appreciated these past three days?

RM: Gold has increased several hundred dollars. Consider how much the dollar has depreciated against other currencies, so yes, gold has been performing magnificently, as expected during such turmoil.

BM: Indeed, it’s a massive warning sign. When gold increases more than $300 in three days — I believe I commented that you wouldn’t want to inhabit a world with $5,000 gold, though everyone disagrees because they desire gold appreciation. However, for gold to climb, global systems must collapse. One crucial topic we should address — are you familiar with the Treasury Basis Trade?

RM: Please elaborate for readers who might be unfamiliar.

BM: Certainly, investment funds trade instruments offering modest returns but minimal risk, so they’ll trade various Treasury maturities against each other, or different monthly contracts, representing an enormous market.

They borrow Japanese currency then invest in these minimal-risk positions. Well, this basis trading strategy is imploding, and the Federal Reserve will need to intervene, probably this weekend. The global financial infrastructure stands on the brink of collapse.

RM: I concur. International investors are retreating from American holdings, seeking European stability instead. Compared to America, German yields remain steady while American 10-year obligations jumped over 40 points — likely the greatest underperformance of Treasuries versus German bunds since ’89. Such conditions simply cannot persist while expecting normal operations; breakdowns become inevitable.

You mentioned previously that America would engage militarily with Iran within weeks. Today’s news indicates Iran is establishing parameters for discussions with America, superficially suggesting genuine negotiation efforts, but I’m skeptical about both parties’ sincerity.

Let me strategize hypothetically.

Suppose American-Iranian talks collapse and America with Israel commence bombing Iranian nuclear facilities.

The Middle East will erupt dramatically. Iranian proxies will become intensely active. Hezbollah maintains over 100,000 rockets. Houthis, characterized by their unyielding determination, will launch everything available at American naval forces.

We’ll witness a reconstituted, well-equipped, better-organized Hamas. Iran controls numerous additional proxy organizations throughout the region and operates a network of agents and supporters worldwide. All will commit aggressive and terrorist acts, religious leaders will issue holy war declarations, regional conflagration will spread globally.

Israel faces complete siege; constant bombardment intensifies. Israel and Turkey, confronting each other in Syria, escalate to military exchanges.

Russia grows emboldened, launching fresh Ukrainian offensives. Chinese and North Korean citizens now fight alongside Russian forces, which no longer employ criminals or mercenaries.

Instead, Russia deploys elite divisions — frontline personnel with cutting-edge equipment — overwhelming undersupplied Ukrainian forces while rapidly advancing.

China needn’t invade Taiwan but could blockade it, interrupting $2.5 trillion in South China Sea commerce and specialized semiconductor exports. Taiwan survives merely six months without external support — lacking energy resources and sufficient food production — before capitulation becomes necessary.

China has conducted live blockade exercises and purged leadership ranks — typical pre-conflict preparations, eliminating conservative veterans while promoting junior commanders: warfighters, zealous younger energetic leaders.

Now imagine three simultaneous conflict zones: Middle East, Taiwan, and Ukraine. My question, Bob: If appointed Joint Chiefs chairman with Trump requesting strategic options, what capabilities assessment would you present regarding American military capacity across these scenarios?

BM: Let me briefly digress with relevant context. Does Trump covet the Nobel Peace Prize?

RM: He deeply envied Obama.

BM: Curiously, remember how briefly Obama held office before receiving his Nobel nomination? 17 days. Obama occupied the presidency merely 17 days before Nobel prize selection. What message was the Nobel committee conveying?

RM: To me, receiving it after just 17 days renders it practically worthless.

BM: Absolutely correct, but Bush initiated numerous global conflicts, and the Nobel committee essentially said this individual has governed 17 days without starting wars, deserving recognition.

RM: He occupied office 17 days without initiating conflicts, earning a Nobel Peace Prize? Perfect — would you receive two after a full month?

BM: Precisely. Trump recognizes this — he’s self-important and genuinely desires the Nobel Peace Prize. Now, can one practice genocide while simultaneously receiving the Nobel Peace Prize? There are two actions he could take to secure it. Would you like to know them?

RM: Definitely.

BM: First, he contacts Netanyahu saying, “We’ve terminated your unlimited American financial support. We’re ceasing payment for this pointless conflict. Withdraw your forces; the war ends.” Netanyahu would comply immediately, having no alternatives.

This isn’t Israel versus Hamas, Hezbollah, or Houthis — it’s America versus these groups. Trump could terminate hostilities within 24 hours.

That’s half the Nobel qualification — what’s the remainder? He contacts Zelensky saying, “Hostilities cease immediately. You have 24 hours to depart Kiev for any destination. This conflict ends now.”

Amazingly, nobody recognizes that Middle Eastern turmoil stems from American involvement, while Russian-Ukrainian hostilities similarly originate from American actions. Trump merely needs to withdraw support.

RM: He hasn’t done so despite having opportunities, suggesting reluctance. Why?

BM: He’s controlled by Israel, demonstrably. Recall that New York trial where he allegedly exaggerated income and assets? Remember that civil proceeding?

RM: Yes, he was convicted of approximately 34 fraud charges.

BM: Consider this remarkable situation: The judge mandated full payment of penalties before appeal rights. Remember, the entire case concerned Trump’s finances — the judge knew precisely Trump’s financial position.

Trump lacked $450 million for court payments enabling appeals. This case represents perhaps the most egregious example of politically-motivated prosecution I’ve encountered — makes canceling Romanian elections seem trivial.

I appreciate certain Trump policies but dislike New York’s corrupted legal system. When the judge demanded immediate payment, where did Trump secure funds?

RM: Perhaps Russia?

BM: Not Russia—a Jewish billionaire. Netanyahu essentially controls Trump. Now regarding Iran’s supposedly unreasonable demands.

RM: I mentioned numerous conditions including American non-starters.

BM: Essentially, American demands require Iran surrendering all defensive capabilities — literally permitting American military forces entry to destroy defensive systems.

Iran will never accept such terms — absolutely impossible. Trump appears to be constructing narratives forcing Iranian rejection, justifying subsequent attacks.

Note some subtle indicators: Six B2 bombers plus support aircraft stationed at Diego Garcia. This relatively compact base requires advance parking reservations months ahead.

America has reserved these spaces only until May 1st. Whatever America intends must occur before April concludes.

RM: Returning to my question: As Joint Chiefs chairman, what capability assessment would you present regarding American armed forces?

BM: Simply put: How many Ukrainian battles has America won during three years? Zero. What chances exist for American/NATO success against Russia? None.

Regarding Israeli/American strikes against Iran: I’ll assert seniority here — I piloted fighters at age 20. Then, the F-4 represented perhaps the world’s premier fighter. I was globally the youngest fighter pilot, completing 125 Vietnamese missions in F-4s — approximately 95% ground attack rather than air superiority — plus another 700 missions in observation aircraft coordinating airstrikes, naval gunfire, and artillery. Combining any 10 warfare/aviation experts, my knowledge exceeds their collective expertise.

I recognize nuances few others perceive. During the second Israeli/American attack on Iran, they deployed aircraft waves including Israeli and American F-35s — the world’s most advanced stealth fighters preparing to penetrate Iranian airspace. Approximately 200 kilometers from Iranian borders, suddenly they appeared on radar. These pilots realized, “They can see us,” contradicting stealth expectations.

Trump’s best option — and indeed American military leadership’s wisest counsel — would be surrender recommendations. If America attacks Iran, expect something resembling the Marianas Turkey Shoot—the final major carrier engagement featuring hundreds of downed Japanese aircraft.

RM: The Battle of the Philippine Sea, nicknamed the Great Marianas Turkey Shoot. Who represents the “turkeys” this occasion?

BM: Isreal.

RM: American naval forces should avoid Chinese waters, maintaining 500-kilometer distances because sequential missile waves would overwhelm defensive capabilities, resulting in destruction.

Regarding Ukraine, we’ve observed Trump’s treatment of Zelensky, NATO, and European Union members. NATO, Ukraine, and EU stand isolated.

Let’s discuss why initiating Chinese trade conflicts remains foolish.

As a combat veteran, military engagements consume extraordinary quantities of munitions and equipment; continuous fighting depletes stockpiles rapidly. Units receive allocated supplies, with prepositioned equipment distributed globally and domestic reserves.

How quickly would American military exhaust smart missile and bomb inventories, plus semiconductor components essential for warfare technologies?

BM: The insanity lies in America repeating Israel’s mistakes. Their arrogance suggests unlimited capabilities. In purely conventional warfare scenarios, America would deplete everything within two to three months — completely emptying warehouses.

RM: Would strategic planning change, arrogance diminish, or would fabrications and denials escalate if I revealed replenishment impossibility?

If I explained how restricting American access to rare earth elements effectively cripples military capabilities — that current stockpiles, once depleted, remain irreplaceable?

BM: They’d dismiss such warnings, but you’ve identified the critical vulnerability. This explains why American current trajectory remains so dangerous.

American arrogance guarantees defeat. I cannot fathom challenging China, yet Trump’s entire administration advocates precisely that. Trump attempts maintaining American global economic dominance but has instead demolished international economic structures.

RM: Fundamentally, American military cannot risk engagement presently. Conflicts with Iran, China, Russia — essentially anyone except Panama or Greenland — would consume semiconductor and rare earth stockpiles, leaving America precariously vulnerable.

BM: Completely accurate— America would become defenseless.

Everyone suggests Russia intends attacking European Union nations. Russia harbors no such intentions — what benefit would they derive?

This represents warfare between Western debt-based systems versus Eastern resource-based systems. Western powers refuse acknowledging defeat.

RM: I perceive American myopic focus on China while being manipulated into unwinnable conflicts because China controls essential rare earth supplies.

Without rare earths, stealth technology becomes impossible. Without rare earths, engine turbine blades overheat and melt, computers become inoperable without necessary chips and elements. Missiles lose precision, standoff capabilities, and guided munitions features. That’s merely sampling what rare earths enable in single weapons platforms like F-35s.

Rare earth applications permeate throughout modern military systems, integrated within all high-technology equipment. Without Chinese resupply, modern warfare becomes impossible.

BM: Every electronic component incorporates rare earths. China supplies nearly 85% of American rare earth requirements and derivative technologies. Trump’s actions demonstrate astounding foolishness.

RM: Bond markets communicate clearly — they demonstrate greater intelligence than equity markets, revealing underlying problems.

BM: Beyond intelligence comparisons, they’re eight times larger than stock markets.

RM: People increasingly recognize potential global financial catastrophe if bond markets continue deteriorating. If presidential temperament fails over perceived insults, what remains afterward?

BM: Completely correct —10-year notes exceed 4.5% yields while 30-year instruments approach 5%. These conditions spell disaster. Previously I described gold as global financial system thermometers indicating potential conflicts. Gold appreciating $300+ within three days signals catastrophe.

RM: Indeed, we’ve long maintained we wouldn’t want inhabiting worlds with $5,000 gold prices, understanding conditions creating such valuations. We appear well-positioned toward that destination, friend.

BM: Let me emphasize something crucial. During 1929, average investors accessed information. Today, how much additional information becomes available to typical investors?

RM: I’d suggest greater quantities exist, but quality suffers — most represents pure nonsense. Supposedly 85% of statistics materialize spontaneously. Information abundance creates overload, mostly incorrect. During 1929, perhaps superior circumstances prevailed because available information remained trustworthy.

BM: They received information via radio and newspapers twice daily. We access 1,000-fold more information, and while substantial misinformation exists, genuinely valuable information abounds too. Several years hence, we’ll recognize our initial interview demonstrated remarkable accuracy and candor.

RM: Current events will likely unfold as predicted despite our preferences. Reviewing daily developments, I’ve never witnessed comparable situations. Having invested 24 years — beginning with junior resource sectors and starting Ahead of the Herd simultaneously with you and your wife launching 321Gold.

We’ve reached this juncture, transitioning from technology bull markets through commodity bull markets centered around China. We’ve witnessed tremendous transformation during recent decades: repeated collapses, numerous recoveries. You might describe us as battle-hardened market veterans experiencing everything between extremes, recalling dramatic challenges, chaotic periods, and prosperous seasons throughout these years.

Surely we’ve gained insights from these experiences, making our accurate assessments unsurprising during conversations.

BM: It frightens me because transformation rates exceed anything previously encountered or studied. Quinton Hennigh represents my closest colleague; we constantly discuss investments and pursue ongoing projects. When gold appreciates $100+ daily, that’s extraordinary — gold doesn’t typically fluctuate 3% daily yet has moved 9% across three days — both amazing and terrifying.

RM: Both amazing and terrifying indeed.

Today we’re discussing two gold companies. You wanted examining New Found Gold Corp. (NFG:TSX.V; NFGC:NYSE.American), which released resource estimates causing selloffs. What’s your perspective regarding New Found Gold, Bob?

BM: Excellent question since I appreciate that story. Would you accept that Qualified Person resource estimates involve considerable interpretive elements? Different QPs can produce entirely different calculations. Historically mining enterprises would select preferred QPs, and during past 25 years numerous 43-101 reports appeared clearly unreliable.

RM: Resource estimates can reflect varying conservatism levels.

BM: Practical considerations emerge — imagine encountering high-grade sections measuring 75 grams across 3 meters. Using those precise measurements guarantees inaccuracy because analysts halve drill cores, sampling 3-meter sections where gold distributes unevenly between halves, requiring maximum value limitations.

Instead of reporting 75 grams across 3 meters, they might cap values at 8-10 grams across 3 meters. Advantageously, with numerous nugget-rich high-grade deposits subject to capping, actual production typically yields higher grades than resource indications.

Every QP maintains certain biases, which company executives recognize. Seeking exceptionally conservative 43-101 reports, instead of reporting 10 grams, they might report 5 grams.

I believe New Found Gold management excessively capped values deliberately producing exactly 2 million ounces. Examining hundreds of high-grade intersections, you’d question how they measured merely 2 million gold ounces.

They necessarily possess greater quantities. Indeed, I consider their 43-101 exceptionally — deliberately — conservative, offering investors tremendous acquisition opportunities for quality enterprises at reduced prices. Consider additionally:

When New Found Gold acquired Labrador Gold’s project, they exchanged approximately 5.2 million shares, which Labrador Gold subsequently liquidated throughout recent months. Consequently, excessive share supply combined with extraordinarily conservative 43-101 reporting artificially suppressed valuations.

Without Labrador Gold releasing those 5 million shares, New Found Gold might command substantially higher valuations — perhaps two or three times current levels. Essentially, both New Found Gold management decisions and Labrador Gold management actions have artificially depressed New Found Gold prices.

New Found Gold represents deposits resembling Fosterville, which transformed Kirkland Lake from $3 billion enterprise into $18 billion corporation—New Found Gold possesses identical potential.

RM: Let me discuss Storm Exploration (STRM:TSX.V). When acquiring companies featuring competent management, excellent properties containing existing gold deposits, priced at pennies — CA$0.03 — with micro-market capitalizations of CA$2 million, trading below shell values, and financing imminent exploration programs like this summer’s drilling, with reasonable success probabilities targeting previously explored areas showing decent grades and intersections — that describes STRM perfectly.

Examining Storm Exploration, they’ve identified gold within banded iron formations across Miminiska-Fort Hope Greenstone Belt. They’ve confirmed high-grade gold zones separated by 14 kilometers — Frond eastward and Miminiska westward — with central gold showings scheduled for summer drilling.

Bruce Counts serves as CEO with John Williamson participating, combining quality advisors and management experienced with gold in banded iron formations. I appreciate this project—14 kilometers containing potentially mineralized gold zones, favorable share distribution, strong ownership, available at $0.03 with $2 million market capitalization.

BM: How much further could valuations decline? Annual operational costs approach $1,000,000. We’re approaching circumstances — and I monitor sentiment — where average investors completely miss resource stock opportunities. Consider current gold stocks.

With gold approaching $3,300, nearly all deposits become economically viable. Nobody incorporates these factors into market valuations. Current gold resource stock prices relative to gold prices represent 45-year lows, conditions that cannot persist indefinitely.

RM: Certainly not, which underlies my emphasis on encouraging investor attention toward our discussions. Where does junior resource company value exist?

Examining companies like Storm, I evaluate market capitalization growth potential — could values multiply 3-5 times following successful exploration programs?

Today’s greatest investment opportunities involve acquiring penny-level juniors financing imminent drilling programs. That’s where value exists, where I prefer investing. Single promising discoveries from microscopic market capitalization enterprises yield what consequences?

BM: Let’s calculate mathematically. With Storm’s $2,000,000 market capitalization, what’s the minimum possible valuation?

RM: Probably won’t decline further.

BM: Theoretically, values could reach zero. Following positive results, what maximum valuations become possible?

RM: With $2 million market capitalization potentially reaching $8-10 million post-financing following successful exploration amidst favorable precious metals environments, such projections seem reasonable.

Let’s conclude here. Thank you, Bob.

BM: Let’s reconnect soon.

You can view more from Rick and Bob at Ahead of the Herd and 321Gold.

Sign up for our FREE newsletter at: www.streetwisereports.com/get-news

Important Disclosures:

- Silver47 Exploration Corp. has a consulting relationship with Street Smart an affiliate of Streetwise Reports. Street Smart Clients pay a monthly consulting fee between US$8,000 and US$20,000.

- As of the date of this article, officers and/or employees of Streetwise Reports LLC (including members of their household) own securities of Snowline Gold Corp. and Silver47 Exploration Corp.

- Rick Mills: I, or members of my immediate household or family, own securities of: Harvest Gold. My company has a financial relationship with Harvest Gold and Silver47 Exploration Corp. I determined which companies would be included in this article based on my research and understanding of the sector.

- Bob Moriarty: I, or members of my immediate household or family, own securities of: Sitka, Trifecta, Harvest and Silver47. My company has a financial relationship with Harvest Gold, Trifecta Gold, and Silver47 Exploration Corp. I determined which companies would be included in this article based on my research and understanding of the sector.

- Statements and opinions expressed are the opinions of the author and not of Streetwise Reports, Street Smart, or their officers. The author is wholly responsible for the accuracy of the statements. Streetwise Reports was not paid by the author to publish or syndicate this article. Streetwise Reports requires contributing authors to disclose any shareholdings in, or economic relationships with, companies that they write about. Any disclosures from the author can be found below. Streetwise Reports relies upon the authors to accurately provide this information and Streetwise Reports has no means of verifying its accuracy.

- This article does not constitute investment advice and is not a solicitation for any investment. Streetwise Reports does not render general or specific investment advice and the information on Streetwise Reports should not be considered a recommendation to buy or sell any security. Each reader is encouraged to consult with his or her personal financial adviser and perform their own comprehensive investment research. By opening this page, each reader accepts and agrees to Streetwise Reports’ terms of use and full legal disclaimer. Streetwise Reports does not endorse or recommend the business, products, services or securities of any company.

For additional disclosures, please click here.

Ahead of the Herd Disclosures

Ahead of the Herd newsletter, aheadoftheherd.com, hereafter known as AOTH.

Please read the entire Disclaimer carefully before you use this website or read the newsletter. If you do not agree to all the AOTH/Richard Mills Disclaimer, do not access/read this website/newsletter/article, or any of its pages. By reading/using this AOTH/Richard Mills website/newsletter/article, and whether you actually read this Disclaimer, you are deemed to have accepted it.

( Companies Mentioned: NFG:TSX.V; NFGC:NYSE.American, STRM:TSX.V, )

Source: https://www.streetwisereports.com/article/2025/04/22/looming-global-financial-crisis-as-gold-prices-surge-to-historic-highs.html

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Before It’s News® is a community of individuals who report on what’s going on around them, from all around the world. Anyone can join. Anyone can contribute. Anyone can become informed about their world. "United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

LION'S MANE PRODUCT

Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules

Mushrooms are having a moment. One fabulous fungus in particular, lion’s mane, may help improve memory, depression and anxiety symptoms. They are also an excellent source of nutrients that show promise as a therapy for dementia, and other neurodegenerative diseases. If you’re living with anxiety or depression, you may be curious about all the therapy options out there — including the natural ones.Our Lion’s Mane WHOLE MIND Nootropic Blend has been formulated to utilize the potency of Lion’s mane but also include the benefits of four other Highly Beneficial Mushrooms. Synergistically, they work together to Build your health through improving cognitive function and immunity regardless of your age. Our Nootropic not only improves your Cognitive Function and Activates your Immune System, but it benefits growth of Essential Gut Flora, further enhancing your Vitality.

Our Formula includes: Lion’s Mane Mushrooms which Increase Brain Power through nerve growth, lessen anxiety, reduce depression, and improve concentration. Its an excellent adaptogen, promotes sleep and improves immunity. Shiitake Mushrooms which Fight cancer cells and infectious disease, boost the immune system, promotes brain function, and serves as a source of B vitamins. Maitake Mushrooms which regulate blood sugar levels of diabetics, reduce hypertension and boosts the immune system. Reishi Mushrooms which Fight inflammation, liver disease, fatigue, tumor growth and cancer. They Improve skin disorders and soothes digestive problems, stomach ulcers and leaky gut syndrome. Chaga Mushrooms which have anti-aging effects, boost immune function, improve stamina and athletic performance, even act as a natural aphrodisiac, fighting diabetes and improving liver function. Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules Today. Be 100% Satisfied or Receive a Full Money Back Guarantee. Order Yours Today by Following This Link.