Expect Gold To Shine In 2025

Authored by Michael Wilkerson via The Epoch Times,

This year has started off with a golden hue. Gold and silver have been among the best-performing asset classes in 2025, up 12 percent and 14 percent, respectively, year-to-date. Over the past two months, these precious metals have outperformed bitcoin, which was the best performing asset in 2024, and equity markets around the world. Gold looks positioned to easily top $3,000 in coming weeks, with silver similarly hitting all-time highs.

There are many reasons to believe that gold prices have further to run from here. Some of the biggest factors supporting a higher gold price include the ongoing accumulation of gold by central banks, persistent inflation, and a global supply shortage of physical gold.

Central banks, which hold as much as 20 percent of total global gold reserves, are key to the long-term growth in demand for the metal. In recent years, central banks around the world have been accumulating substantial quantities of gold. Net central bank acquisitions of gold topped 1,045 metric tons in 2024, marking the third year in a row of purchases above 1,000 metric tons. These figures reflect the publicly disclosed amounts; many observers believe that China and other countries are secretly acquiring gold well in excess of reported volumes. Most of the buying has come from outside of the United States and Western Europe. The four largest sovereign holders, the United States, Germany, France, and Italy, have been the exception to the gold rush led by the BRICS and other developing nations, and have not acquired additional reserves.

The reason for the failure of the United States and “Old Europe” nations to acquire more gold is simple. Most of them do not have the money. The United States, Italy and France are each deeply indebted, with debt to gross domestic product well in excess of 100 percent. These countries are forced to use proceeds of issuance of government securities to fund ever-growing government deficits, not to acquire gold or other valuable assets.

The rise in gold prices coincides with the decline in influence of the global reserve currency. The weaponization of the U.S. financial system which began in earnest in 2022 motivated many nations to diversify their sovereign holdings away from the U.S. dollar. Gold has been the primary beneficiary. The inverse is also true. Central bank purchases of gold have come at a cost to the U.S. dollar. For several years, countries around the world have been selling U.S. Treasuries held in their foreign reserve accounts to fund their gold purchases. This has made borrowing by the U.S. Treasury more expensive. Tying alternative payment mechanisms to gold collateral has put pressure on the U.S. dollar’s role in world markets.

Inflation has proven more persistent than central bankers are willing to admit. In the United States, January’s CPI reading came in above expectations at 3 percent, and core inflation (excluding food and energy prices) was even higher at 3.3 percent. Inflation has now run hot for over three years, with the general price level up over 20 percent since 2021. Over a longer run, the U.S. money supply has trebled since the global financial crisis of 2008, while the gold supply has grown by only 1 percent to 2 percent per year. Gold prices, which are expressed in dollar terms, have thus tripled alongside the money supply, suggesting that gold has been a more honest representation of purchasing power than the depreciating dollar.

Investment markets are speculating that the U.S. government will revalue its gold holdings, still held on the books at a historical cost of just over $42 per ounce, to the current market value of nearly $3,000. This would instantly plug a portion (potentially nearly $1 trillion) of the gaping hole in the nation’s balance sheet. President Trump has committed to auditing the U.S. government’s gold stockpile, officially on the books at 8,133 metric tons, for the first time in half a century. A successful physical audit would boost confidence in the financial position of the United States, while a shortfall would shock global financial markets and further denigrate the credibility of not just the United States but governments around the world.

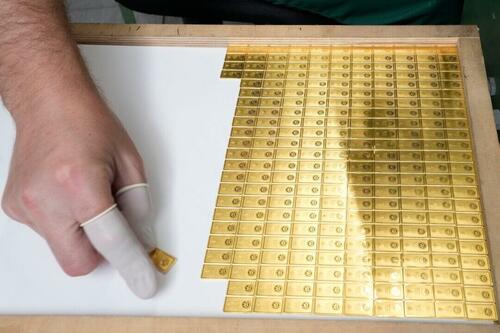

There is a shortage of physical gold. The London Bullion Market Association is the center of gold trading around the world. Many nations have historically held their gold reserves with the Bank of England, but in recent years have been repatriating their holdings. This has disrupted the London markets and put pressure on prices.

In recent weeks, demand for delivery of physical gold has skyrocketed. Geopolitical concerns have led to a massive movement of physical gold out of the UK and Europe into vaults in New York and elsewhere. This has led to shortages and speculation of price manipulation. European markets have been spooked by President Trump’s saber-rattling over tariffs, and price differentials have opened up between gold markets across the Atlantic, accelerating the movement of bullion into the United States.

This spike in demand for physical gold, and resulting logistical bottlenecks, are not only pressuring gold prices but potentially creating a demand spiral. Analogous to a deposit run on a bank, gold customers concerned about the security of their holdings may accelerate demands to withdraw them. This could further squeeze physical supply and quickly boost prices. Many gold derivative contracts are linked to underlying physical collateral. If this collateral can’t be secured, the contracts can fail. This is one reason why holding physical gold is vastly superior to exchange-traded funds or other investment contracts that can’t guarantee delivery of the collateral on demand.

Some gold industry observers have argued that there is evidence that the handful of large banks that issue most of the gold derivatives contracts have acted in concert to manipulate the price of gold. An illegal pricing cartel among the banks would not be unprecedented. The public discovered similar practices in the mortgage securities fraud leading up to the global financial crisis and in the manipulation of LIBOR (the interest rate at which banks lend to one another) uncovered a few years later.

The recent sharp rise in gold prices may put pressure on these banks and lead to instability in any price fixing arrangement. If the cartel unwinds, it could come quickly and violently. There would be winners and losers, and potential contagion into other markets. In other words, gold derivatives may become the epicenter of the next financial crisis. In such an event, demand for physical gold would spike further, as would prices.

Views expressed in this article are opinions of the author and do not necessarily reflect the views of The Epoch Times or ZeroHedge.

Tyler Durden Sun, 02/23/2025 – 09:20

Source: https://freedombunker.com/2025/02/23/expect-gold-to-shine-in-2025/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Before It’s News® is a community of individuals who report on what’s going on around them, from all around the world. Anyone can join. Anyone can contribute. Anyone can become informed about their world. "United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

LION'S MANE PRODUCT

Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules

Mushrooms are having a moment. One fabulous fungus in particular, lion’s mane, may help improve memory, depression and anxiety symptoms. They are also an excellent source of nutrients that show promise as a therapy for dementia, and other neurodegenerative diseases. If you’re living with anxiety or depression, you may be curious about all the therapy options out there — including the natural ones.Our Lion’s Mane WHOLE MIND Nootropic Blend has been formulated to utilize the potency of Lion’s mane but also include the benefits of four other Highly Beneficial Mushrooms. Synergistically, they work together to Build your health through improving cognitive function and immunity regardless of your age. Our Nootropic not only improves your Cognitive Function and Activates your Immune System, but it benefits growth of Essential Gut Flora, further enhancing your Vitality.

Our Formula includes: Lion’s Mane Mushrooms which Increase Brain Power through nerve growth, lessen anxiety, reduce depression, and improve concentration. Its an excellent adaptogen, promotes sleep and improves immunity. Shiitake Mushrooms which Fight cancer cells and infectious disease, boost the immune system, promotes brain function, and serves as a source of B vitamins. Maitake Mushrooms which regulate blood sugar levels of diabetics, reduce hypertension and boosts the immune system. Reishi Mushrooms which Fight inflammation, liver disease, fatigue, tumor growth and cancer. They Improve skin disorders and soothes digestive problems, stomach ulcers and leaky gut syndrome. Chaga Mushrooms which have anti-aging effects, boost immune function, improve stamina and athletic performance, even act as a natural aphrodisiac, fighting diabetes and improving liver function. Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules Today. Be 100% Satisfied or Receive a Full Money Back Guarantee. Order Yours Today by Following This Link.