Key Events This Week: Peak Earnings Season, Canada Election, Payrolls, PCE, GDP… And Trade War Goes On

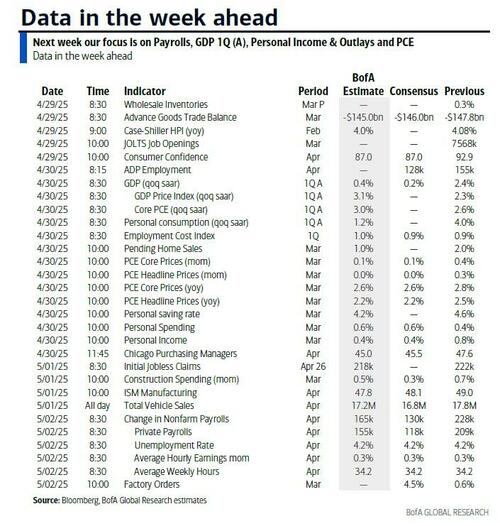

This week will be the first for a while where data and earnings will compete with tariff headlines as it’s a bumper week on this front. According to DB”s Jim Reid, in terms of data the main highlights in the US are payrolls (Friday), core PCE inflation and US GDP (Wednesday), ISM manufacturing (Thursday) and the latest JOLTS and consumer confidence tomorrow.

In Europe flash CPI numbers get released from Spain tomorrow, Germany, France and Italy on Wednesday, with the Eurozone aggregate on Friday (our economists’ preview is here). On Wednesday, Q1 GDP reports are due for Germany, France, Italy and the Eurozone. In Asia, the focus will be on the BoJ meeting (Thursday – our preview here) and April PMIs in China (Wednesday).

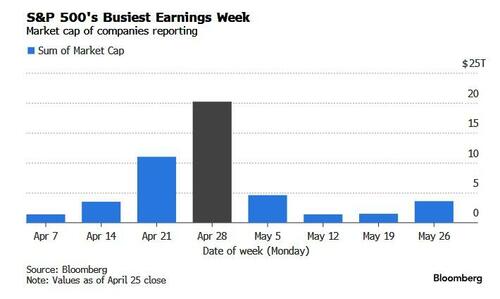

Besides the macro, we get an avalanche of micro as we face the busiest week of Q1 earnings season with corporate reporting centering around results from Microsoft and Meta on Wednesday and Apple and Amazon on Thursday. This will contribute to a whopping 40% of S&P 500 market cap reporting this week.

It’s fair to say that Mag-7 earnings will go a long way to dictating the tone of the week, and perhaps quarter, now that the worst of tariffs appears to be behind us. As Jim Reid mentioned last week, remember that before Liberation Day the main theme bubbling in the background was the Mag-7 underperforming due to DeepSeek, worries about extreme levels of Capex needed to power AI forward, valuations and a disappointing Q4 reporting season around the end of January. Three months on we’ll see what earnings look like.

Elsewhere we see the federal election in Canada today. Remember the ruling Liberal Party were frequently 25% behind in the polls in early-mid January even after Trudeau had announced his resignation as leader. However after the “51st state” rhetoric and aggressive tariffs, the rally round the flag movement has propelled the Liberals into a 3-4pp lead in current poll of polls which if replicated today would likely give them a small majority. So a remarkable turnaround.

Elsewhere in politics, Wednesday will mark President Trump’s first 100 days in office. So expect lots of reflections on this landmark. The UK holds local elections on Thursday with the main point of interest being how well the populist Reform Party does given they have recently edged ahead of the ruling Labour Party in national polls.

So its fair to say it will be a busy week.

Let’s go into more detail on some of the main data points. Firstly, in terms of payrolls, DB economists forecast that headline (+125k forecast vs. +228k previously) and private (+125k vs. +209k) payrolls will mean revert after a strong March, particularly within the leisure/hospitality and retail sectors. The bank’s econ team point out that March and April can get whipped around due to the timing of Easter and school spring breaks. Unemployment should remain steady at 4.2% though.

Wednesday’s advance Q1 GDP will be interesting as the consensus suggests only +0.4% annualized growth in the quarter (+1.1% expected at DB vs. +2.4% in Q4) so that will raise some concerns if it materializes. At the same time DB sees March personal income (+0.5% DB vs. +0.4% last month) and spending (+0.6% DB vs. +0.4%) data. This will also contain the latest reading on the core PCE deflator (+0.1% vs. +0.4%) which is expected to be on the softer side this month. This will be welcome but remember this is all largely pre-tariffs.

The day by day week ahead is at the end as usual, including the highlights from a busy week for earnings on both sides of the Atlantic. One final thing to note is the US Treasury’s updated borrowing estimates (today) and the subsequent refunding announcement (Wednesday). This normally gets released without too much fuss but remember that in Summer 2023 (end July/early August) this quarterly announcement helped cause brief but great stress in markets due to higher than expected borrowing and more long-dated issuance. Since then the Treasury has managed the process with a view to minimising market fears but in an era of large borrowings these events are always worth keeping an eye out for.

Courtesy of DB, here is a day-by-day calendar of events

Monday April 28

- Data: US April Dallas Fed manufacturing activity, France Q1 total jobseekers

- Central banks: ECB’s Rehn and Guindos speak

- Earnings: Hitachi, Welltower, Waste Management, Cadence Design Systems, Deutsche Boerse, NXP Semiconductors, Domino’s Pizza

- Auctions: US Treasury updated borrowing estimates

- Other: Canadian federal election

Tuesday April 29

- Data: US April Conference Board consumer confidence index, Dallas Fed services activity, March JOLTS report, advance goods trade balance, wholesale inventories, February FHFA house price index, Germany May GfK consumer confidence, Italy April consumer confidence index, manufacturing confidence, economic sentiment, March hourly wages, February industrial sales, Eurozone March M3, April economic, industrial, services confidence, Sweden Q1 GDP indicator

- Central banks: ECB’s March consumer expectations survey, Holzmann and Cipollone speak, BoE’s Ramsden speaks

- Earnings: Visa, Coca-Cola, Novartis, China Construction Bank, AstraZeneca, HSBC, Booking, S&P Global, Pfizer, Honeywell, Spotify, American Tower, Altria, Starbucks, Mondelez, Sherwin-Williams, UPS, BBVA, BP, Atlas Copco, Ecolab, Regeneron, PayPal, Royal Caribbean Cruises, Wal-Mart de Mexico, Universal Music Group, Hilton, Fair Isaac, adidas, GM, Corning, Kraft Heinz, CoStar, Ares

Wednesday April 30

- Data: US Q1 GDP, employment cost index, April ADP report, MNI Chicago PMI, March core PCE, personal income and spending, pending home sales, China April official PMIs, Caixin manufacturing PMI, UK April Lloyds Business Barometer, Japan March retail sales, industrial production, housing starts, Germany April CPI, retail sales, import price index, unemployment claims rate, Q1 GDP, France April CPI, March PPI, consumer spending, Q1 GDP, Italy April CPI, March PPI, Q1 GDP, Eurozone Q1 GDP, Canada February GDP, Australia Q1 CPI

- Central banks: ECB’s Muller speaks, BoE’s Lombardelli speaks

- Earnings: Microsoft, Meta, Samsung, Qualcomm, Caterpillar, TotalEnergies, Airbus, Iberdrola, Santander, UBS, KLA, Equinix, GSK, Tokyo Electron, MediaTek, Equinor, Mercedes-Benz Group, Credit Agricole, Barclays, Volkswagen, CaixaBank, Deutsche Post, Haleon, Robinhood, Societe Generale, Humana, eBay, GE HealthCare, ArcelorMittal, Evolution AB, Repsol, Norwegian Cruise Line, Albemarle, Wingstop, Etsy

- Auctions: US Treasury quarterly refunding announcement

Thursday May 1

- Data: US April ISM index, total vehicle sales, March construction spending, initial jobless claims, UK March net consumer credit, M4, Japan April consumer confidence index, Canada April manufacturing PMI

- Central banks: BoJ’s decision

- Earnings: Apple, Amazon, Eli Lilly, Mastercard, McDonald’s, Linde, Amgen, Stryker, KKR, MicroStrategy, CVS Health, Airbnb, Parker-Hannifin, Lloyds Banking Group, Howmet Aerospace, Dominion Energy, Roblox, Targa Resources, Block, Hershey, Live Nation Entertainment, Kellanova, Blue Owl Capital, Estee Lauder, Reddit, Cameco, Duolingo, Twilio, Juniper Networks, Maplebear, Moderna, United States Steel, Roku, Wayfair, Harley-Davidson

- Other: UK local elections

Friday May 2

- Data: US April jobs report, March factory orders, Japan April monetary base, March jobless rate, job-to-applicant ratio, France March budget balance, Italy April manufacturing PMI, budget balance, new car registrations, March unemployment rate, Eurozone April CPI, March unemployment rate

- Central banks: ECB’s economic bulletin

- Earnings: Exxon Mobil, Chevron, Shell, Eaton, Cigna Group, Mitsubishi, Apollo, ING, NatWest, BASF, Standard Chartered, DuPont de Nemours

* * *

FInally, looking at just the US, Goldman writes that the key economic data releases this week are the Q1 advance GDP report and core PCE inflation on Wednesday and the employment report on Friday. Fed officials are not expected to comment on monetary policy this week, reflecting the blackout period ahead of the May FOMC meeting.

Monday, April 28

- There are no major economic data releases scheduled.

Tuesday, April 29

- 08:30 AM Advance goods trade balance, March (GS -$146.0bn, consensus -$143.0bn, last -$147.8bn); We forecast that the advance goods trade deficit narrowed by $1.8bn to $146.0bn in the March advance report, reflecting a $10bn decline in gold imports that was offset by a $10bn increase in imports from major Asian trading partners.

- 08:30 AM Wholesale inventories, March preliminary (consensus +0.7%, last +0.3%)

- 09:00 AM FHFA house price index, February (consensus +0.3%, last +0.2%)

- 09:00 AM S&P Case-Shiller 20-city home price index, February (GS +0.5%, consensus +0.4%, last +0.5%)

- 10:00 AM JOLTS job openings, March (GS 7,400k, consensus 7,500k, last 7,568k): We estimate that JOLTS job openings edged down to 7.4mn in March based on the signal from online job postings.

- 10:00 AM Conference Board consumer confidence, April (GS 90.0, consensus 87.0, last 92.9)

Wednesday, April 30

- 08:15 AM ADP employment change, April (GS +110k, consensus +124k, last +155k)

- 08:30 AM GDP, Q1 advance (GS -0.2%, consensus +0.4%, last +2.4%); Personal consumption, Q1 advance (GS +0.9%, consensus +1.2%, last +4.0%); Core PCE inflation, Q1 advance (GS +3.32%, consensus +3.0%, last +2.6%): We estimate that GDP fell 0.2% annualized in the advance reading for Q1, following +2.4% annualized growth in Q4. Our forecast reflects a slowdown in consumption growth (+0.9%, quarter-over-quarter annualized), a sharp increase in imports growth (+24.0% vs. -1.9% in Q4), and a decline in residential investment (-8.2% vs. +5.5% in Q4), but a pickup in business fixed investment growth (+7.3% vs. -3.0% in Q4), stronger exports growth (+6.8% vs. -0.2% in Q4), and a rebound in inventory accumulation. We estimate that the core PCE price index increased 3.32% annualized (or 2.77% year-over-year) in Q1.

- 08:30 AM Employment cost index, Q1 (GS +0.95%, consensus +0.9%, last +0.9%): We estimate the employment cost index rose by 0.95% in Q1 (quarter-over-quarter, seasonally adjusted), which would lower the year-on-year rate by two tenths to 3.6% (year-over-year, not seasonally adjusted). Our forecast reflects a sequential acceleration in wage and salary growth—reflecting the signal from the Atlanta Fed’s wage tracker—and slightly firmer ECI benefit growth—reflecting resets to start the year.

- 09:45 AM Chicago PMI, April (consensus 46.0, last 47.6)

- 10:00 AM Personal income, March (GS +0.2%, consensus +0.4%, last +0.8%); Personal spending, March (GS +0.5%, consensus +0.6%, last +0.4%); Core PCE price index, March (GS +0.08%, consensus +0.1%, last +0.4%); Core PCE price index (YoY), March (GS +2.67%, consensus +2.6%, last +2.8%); PCE price index, March (GS flat, consensus flat, last +0.3%); PCE price index (YoY), March (GS +2.32%, consensus +2.2%, last +2.5%): We estimate that personal income and personal spending increased by 0.2% and 0.5%, respectively, in March. We estimate that the core PCE price index rose by 0.08% in March, corresponding to a year-over-year rate of 2.67%. Additionally, we expect that the headline PCE price index remained unchanged from the prior month, corresponding to a year-over-year rate of 2.32%. Our forecast is consistent with a 0.15% increase in our trimmed core PCE measure (vs. 0.26% in February).

- 10:00 AM Pending home sales, March (GS +7.0%, consensus +1.0%, last +2.0%)

Thursday, May 1

- 08:30 AM Initial jobless claims, week ended April 26 (GS 225k, consensus 225k, last 222k); Continuing jobless claims, week ended April 19 (consensus 1,860k, last 1,841k)

- 09:45 AM S&P Global US manufacturing PMI, April final (consensus 50.7, last 50.7)

- 10:00 AM ISM manufacturing index, April (GS 47.5, consensus 48.0, last 49.0): We estimate the ISM manufacturing index declined by 1.5pt to 47.5 in April, reflecting softer manufacturing surveys so far for April (GS manufacturing survey tracker: -3.1pt to 47.4) and a slight headwind from residual seasonality.

- 10:00 AM Construction spending, March (GS +0.3%, consensus +0.2%, last +0.7%)

- 05:00 PM Lightweight motor vehicle sales, April (GS 17.2mn, consensus 17.1mn, last 17.8mn)

Friday, May 2

- 08:30 AM Nonfarm payroll employment, April (GS +140k, consensus +130k, last +228k); Private payroll employment, April (GS +140k, consensus +120k, last +209k); Average hourly earnings (MoM), April (GS +0.25%, consensus +0.3%, last +0.3%); Unemployment rate, April (GS 4.2%, consensus 4.2%, last 4.2%): We estimate nonfarm payrolls rose 140k in April. On the positive side, big data indicators indicated a slower but still moderate pace of job creation. On the negative side, we expect unchanged government payrolls, reflecting a 15k decline in federal government payrolls that offsets a 15k increase in state and local government payrolls. We see mixed implications from potential seasonal distortions: while April nonfarm payroll growth has typically picked up when the Easter holiday falls in late April, uncertainty is likely to disproportionately weigh on employment growth in months where gross hiring is particularly elevated, such as April. We estimate that the unemployment rate was unchanged at 4.2% on a rounded basis. We estimate average hourly earnings rose 0.25% (month-over-month, seasonally adjusted), reflecting negative calendar effects.

- 10:00 AM Factory orders, March (GS +5.0%, consensus +4.5%, last +0.6%)

Source: DB, Goldman

Tyler Durden Mon, 04/28/2025 – 09:55

Source: https://freedombunker.com/2025/04/28/key-events-this-week-peak-earnings-season-canada-election-payrolls-pce-gdp-and-trade-war-goes-on/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Before It’s News® is a community of individuals who report on what’s going on around them, from all around the world. Anyone can join. Anyone can contribute. Anyone can become informed about their world. "United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

LION'S MANE PRODUCT

Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules

Mushrooms are having a moment. One fabulous fungus in particular, lion’s mane, may help improve memory, depression and anxiety symptoms. They are also an excellent source of nutrients that show promise as a therapy for dementia, and other neurodegenerative diseases. If you’re living with anxiety or depression, you may be curious about all the therapy options out there — including the natural ones.Our Lion’s Mane WHOLE MIND Nootropic Blend has been formulated to utilize the potency of Lion’s mane but also include the benefits of four other Highly Beneficial Mushrooms. Synergistically, they work together to Build your health through improving cognitive function and immunity regardless of your age. Our Nootropic not only improves your Cognitive Function and Activates your Immune System, but it benefits growth of Essential Gut Flora, further enhancing your Vitality.

Our Formula includes: Lion’s Mane Mushrooms which Increase Brain Power through nerve growth, lessen anxiety, reduce depression, and improve concentration. Its an excellent adaptogen, promotes sleep and improves immunity. Shiitake Mushrooms which Fight cancer cells and infectious disease, boost the immune system, promotes brain function, and serves as a source of B vitamins. Maitake Mushrooms which regulate blood sugar levels of diabetics, reduce hypertension and boosts the immune system. Reishi Mushrooms which Fight inflammation, liver disease, fatigue, tumor growth and cancer. They Improve skin disorders and soothes digestive problems, stomach ulcers and leaky gut syndrome. Chaga Mushrooms which have anti-aging effects, boost immune function, improve stamina and athletic performance, even act as a natural aphrodisiac, fighting diabetes and improving liver function. Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules Today. Be 100% Satisfied or Receive a Full Money Back Guarantee. Order Yours Today by Following This Link.