The Path Ahead: Soar, Stall, Or Plummet

Authored by Lance Roberts via RealInvestmentAdvice.com,

We have good and bad news for investors who want to know whether the stock market will soar, stall, or plummet. First, the good news. This article presents the market path for what lies ahead. Unfortunately, the “right” path is among three likely scenarios.

Despite our inability to definitively show you the way forward, we can share the technical patterns that will help guide us and, in time, assign better odds as to which of the three paths will be the “right” path. Importantly, we also lay out the possible economic, geopolitical, and monetary policy scenarios that would likely correspond with each forecast.

Mapping Our Paths

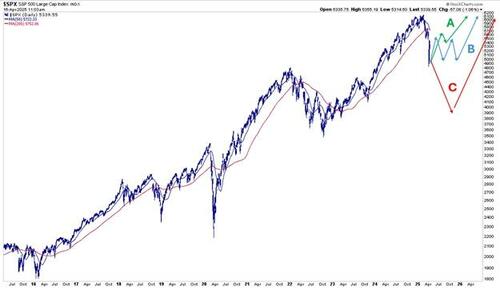

The graph below plots the three most likely market paths going forward.

Forecast A is the most bullish scenario. In this scenario, the S&P 500 has already seen its lows for the cycle. The market will grind higher until it meets resistance near the key 50- and 200-day moving averages. After a brief period of consolidation, the market would break above those important moving averages, the death cross between the two important moving averages would flip back to a golden cross, and new highs would follow.

In our opinion, scenario B is the most likely path. It argues that, like scenario A, we may have seen the year’s lows, but the stock market will consolidate in a wide range for many months before resuming a bullish trend.

C is the most concerning path. It entails a series of lower highs and lower lows for the foreseeable future. Moreover, a recession would most likely accompany this scenario.

We now present each forecast in more detail to better understand which event is most likely and how geopolitical, economic, fiscal, and monetary policy decisions can help guide us down the right path or switch paths as the environment changes.

Scenario A (Soar)- Politics, Economics, and the Fed

This scenario argues that the damage tariffs have caused the markets, and the economy is nearing an end. From a geopolitical perspective, this would mean President Trump and many of our important trade partners are close to signing beneficial trade agreements. Moreover, our bullish scenario would also likely require a trade agreement with China or, at a minimum, constructive discussions.

A less hawkish Fed would also promote this outlook, in addition to tariffs. Chairman Powell came out relatively hawkish in mid-April. He claims the Fed is handcuffed due to its low unemployment and tame inflation mandates. To his point, they would cut rates as early as May if they saw the economy weakening and unemployment rising. However, they are still scared of the inflation boogeyman; thus, they are less likely to cut in advance of weakening labor conditions. In Powell’s opinion, tariffs are temporarily inflationary. But he raised the hawkish specter that they might be persistent.

We must also remember that liquidity in the bond market appears to be a potential problem. Bullish markets are fueled by positive sentiment and ample liquidity. If the Fed addresses the liquidity problem, the odds of a bullish outlook rise.

Lastly, case A assumes that any economic damage caused by tariffs and related consumer and corporate financial decisions is short-lived. The scenario assumes that economic activity will resume at its prior pace once a resolution on the tariffs is reached.

Donald Trump has a so-called “Trump Card” in his back pocket. Tax reductions, reduced regulations, and other pro-business legislation could be additional support for a rally to new highs.

Scenario A- Technical Analysis

The graph below shows multiple areas of potential resistance between 5600 and 5800 for the S&P 500. The combination of the key 50 and 200-day moving averages (5705 and 5751), a Fibonacci retracement level (5630), and the green support/resistance line (5800) will likely keep a lid on prices. However, if the news is bullish enough, it will break through that resistance, resuming the bullish trend, and a record high is more likely.

Scenario B (Stall)- Politics, Economics, and the Fed

Unlike scenario A, scenario B is based on a more extended period for tariff resolution. Furthermore, the signed agreements may not be as economically friendly as we envision for scenario A. Discussions with China may occur. Still, they would likely be embattled with an agreement seemingly far off.

From time to time, tariff deals will be completed, and with each significant trade partner signing an agreement, the market will breathe a sigh of relief and provide optimism, which will help keep a floor on the market near recent lows. Conversely, ongoing trade spats, new tariffs, and retaliatory tariffs will keep a lid on the market.

The potential consolidation range is wide, and activity could be volatile as investors quickly rotate between optimism and pessimism, between the ceiling and the floor. This is the roller coaster scenario we laid out at the beginning of the year.

The Fed may remain hawkish but be willing to cut rates and possibly end QT if tariffs prove to be less of an inflation threat than they worry about. Like trade deals, a more friendly Fed would help keep a floor on losses at the recent lows.

Scenario B- Technical Analysis

We use the same graph as scenario A. However, we added the yellow box to approximate the range the market could travel in throughout most of the year. The consolidation is likely between 5800 and 4900.

Scenario C (Plummet)- Politics, Economics, and the Fed

Scenario C is our bearish outlook. Given that the S&P 500 is already 20+% off its peak, the market is priced to some degree for weaker earnings, slower economic growth, deficit reductions, and prolonged tariff negotiations. For C to play out, i.e., a peak-to-trough decline of 40% or more, the economic outlook and tariff concerns would worsen appreciably.

This scenario would likely coincide with a recession and or a credit event. Moreover, we suspect it also entails that the Fed is slow to react to liquidity issues and the government is providing less fiscal support than normal during downturns.

Corporations will find it hard to make decisions in such an environment and thus have trouble committing capital expenditures. Moreover, with reduced economic activity, they will reduce expenses, including laying off employees. Higher joblessness, a weaker economy, and poor consumer sentiment would result in consumers saving more and spending less.

While this is not our base case forecast, it’s certainly plausible. However, a sharp decline from current levels suggests that the Fed and government do not appreciate, or care, how their policies harm the economy in the short term.

Scenario C- Technical Analysis

Scenario C will likely play out in a series of lower highs and lower lows. Optimistically, this could be like 2022 as shown below. From peak to trough, the S&P 500 fell by 28%. The recent peak to trough was 21%. Thus, if this scenario plays out similarly to 2022, 4400 may mark the low.

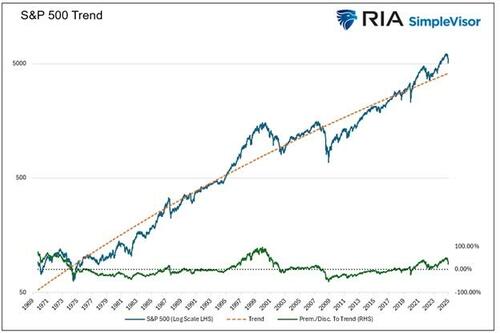

Another way to estimate a potential bottom is to assume the S&P 500 regresses to its long-term trend. Despite the recent decline, the S&P 500 is about 30% above its 55-year trend (4120), as shown below. Unfortunately, as the graph shows, it can fall below its trend and result in an even more significant loss.

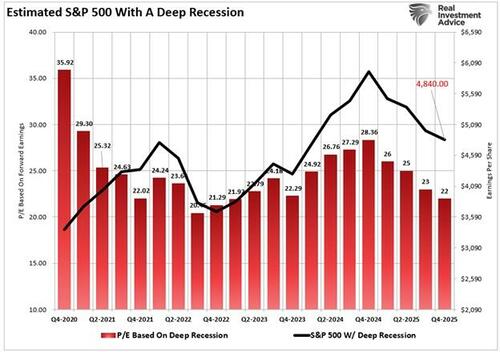

We can also use fundamentals to help us find a reasonable floor. For this exercise, we lean on a valuation analysis we shared in December 2024, which forecasted an S&P price of 4840 if valuations reverted to 2022 levels and earnings growth is flat. As we wrote:

But what if the U.S. encounters a recession due to economic or political policies or a credit-related event? Then, a decline in valuations toward the 2022 level of 22x earnings should be expected. Such would equate to roughly a 20% decline from current levels.

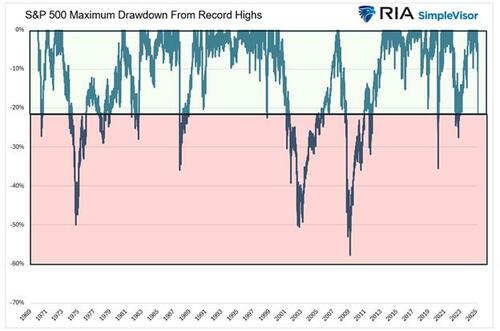

Lastly, we share the graph below to help provide more context for drawdowns from record highs, such as the one we are currently experiencing. Since 1969, nine drawdowns have been worse than the current one. Six of the nine have been limited to -35% or less, leaving three, including the dot-com crash and the financial crisis with larger losses.

Summary

We lean toward scenario B, the roller coaster with periods of intense volatility. If this holds, our ability to follow our trading rules and technical indicators while trying to ignore unproductive behavioral traits will be fully tested.

It’s impossible to predict the path, but considering different scenarios and understanding the likely fundamental factors determining each path provides us with a road map to help us follow one or switch paths if needed.

Tyler Durden Thu, 04/24/2025 – 07:20

Source: https://freedombunker.com/2025/04/24/the-path-ahead-soar-stall-or-plummet/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Before It’s News® is a community of individuals who report on what’s going on around them, from all around the world. Anyone can join. Anyone can contribute. Anyone can become informed about their world. "United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

LION'S MANE PRODUCT

Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules

Mushrooms are having a moment. One fabulous fungus in particular, lion’s mane, may help improve memory, depression and anxiety symptoms. They are also an excellent source of nutrients that show promise as a therapy for dementia, and other neurodegenerative diseases. If you’re living with anxiety or depression, you may be curious about all the therapy options out there — including the natural ones.Our Lion’s Mane WHOLE MIND Nootropic Blend has been formulated to utilize the potency of Lion’s mane but also include the benefits of four other Highly Beneficial Mushrooms. Synergistically, they work together to Build your health through improving cognitive function and immunity regardless of your age. Our Nootropic not only improves your Cognitive Function and Activates your Immune System, but it benefits growth of Essential Gut Flora, further enhancing your Vitality.

Our Formula includes: Lion’s Mane Mushrooms which Increase Brain Power through nerve growth, lessen anxiety, reduce depression, and improve concentration. Its an excellent adaptogen, promotes sleep and improves immunity. Shiitake Mushrooms which Fight cancer cells and infectious disease, boost the immune system, promotes brain function, and serves as a source of B vitamins. Maitake Mushrooms which regulate blood sugar levels of diabetics, reduce hypertension and boosts the immune system. Reishi Mushrooms which Fight inflammation, liver disease, fatigue, tumor growth and cancer. They Improve skin disorders and soothes digestive problems, stomach ulcers and leaky gut syndrome. Chaga Mushrooms which have anti-aging effects, boost immune function, improve stamina and athletic performance, even act as a natural aphrodisiac, fighting diabetes and improving liver function. Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules Today. Be 100% Satisfied or Receive a Full Money Back Guarantee. Order Yours Today by Following This Link.