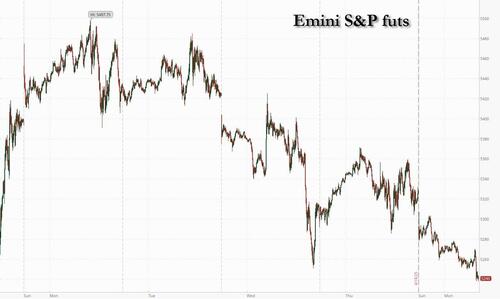

US Stock Futures, Dollar, Treasuries Tumble On Powell Punt Panic; Gold, Bitcoin Soar

With most global markets still closed for Easter holiday, US equity futures start the week sharply lower while the dollar and Treasuries plunge (10s and 30s are 8bp and 10bps higher as the yield curve twists steeper) as traders reacted to the possibility that Trump will try to remove Powell. As of 8:00am ET, S&P futures are down 1.3% and Nasdaq futures slide 1.5% with Mag7 names under pressure with INTC/NFLX among the bright spots in TMT. European stock markets were largely still shut for a public holiday. The dollar is set up to have its worst day in 2 weeks, plunging to a 15 month low, and sending precious metals soaring: gold was above $3400 at last check. Energy is weaker, Ags/base metals are higher. There is also trouble in trade deal land with Japan pushing back on US demands for its trade deal, while China warns trading partners against mistreatment in any deal made with the US. It’s a quiet day with just the Leading index on today’s calendar (10am); Fed’s Goolsbee speaks at 8:30am.

In premarket trading, the Mag 7 are lower, with Tesla the top decliner: TSLA plunged 4% after Wedbush analyst and a Tesla bull Dan Ives warns of a “code red” moment ahead of first-quarter earnings (the rest are also hurting NVDA -3.1%, META -1.3%, AAPL -2%, AMZN -1.7%, GOOGL -1.3% and MSFT -0.9%). Netflix climbed 2.4% after the streaming giant reported record profit to start the year, allaying concerns of a slowdown or fears the streaming leader might be hurt by growing economic uncertainty. Here are some other notable movers:

- Capital One Financial Corp. (COF) rises 2.7% after receiving approval from US regulators to buy Discover Financial Services, a deal that creates the nation’s biggest credit-card issuer by loan volume. Discover (DFS) gains 5%.

- Salesforce (CRM) declines 1.5% after D.A. Davidson downgraded the software company, saying it’s neglecting its core business to pursue a “premature” AI opportunity.

- Spotify (SPOT) climbs 1% after Wolfe Research upgraded its rating, saying there “multiple paths to improved monetization.”

- Taiwan Semiconductor ADRs (TSM) drop 1.9% after the company listed challenges of ensuring export control compliance.

Trump, rightfully frustrated that the central bank hasn’t moved to lower interest rates as even BofA’s Michael Hartnett noted over the weekend…

Fed cut 50bps in Sept when stock market at record high, Atlanta Fed was forecasting +3% US GDP growth; Fed now determined not to cut rates after 20% market plunge, Atlanta Fed forecasting -3% GDP growth

… posted on social media last week that Powell’s “termination cannot come fast enough!” and on Friday, Trump top economic advisor Kevin Hassett said the president is studying whether he’s able to fire Powell.

Rebuking the Fed undermines the principle of central bank independence and risks politicizing US monetary policy in a way that markets will find deeply unsettling, said Christopher Wong, a currency strategist at Oversea-Chinese Banking Corp. “Frankly, firing Powell stretches belief,” said Wong. “If the credibility of the Fed is called into question, it could severely erode confidence in the dollar.”

Trump would put the credibility of the dollar on the line and destabilize the US economy if he fired Powell, French Finance Minister Eric Lombard warned. Fed Chicago President Austan Goolsbee warned against efforts to curtail the central bank’s independence. “There’s virtual unanimity among economists that monetary independence from political interference, that the Fed or any central bank be able to do the job that it needs to do, is really important,” Goolsbee said on CBS’s Face the Nation on Sunday.

In a sign that investors are rotating investments away from the US, Deutsche Bank AG said that Chinese clients have reduced some of their Treasuries holdings in favor of European debt. European high-quality bonds, Japanese government bonds and gold are likely to be the potential choices for investors as alternatives to Treasuries, said Lillian Tao, head of China macro and global emerging market sales at the bank.

In tariff news, China’s largest shipping line, Cosco Shipping, said the US plans to impose levies on Chinese vessels docking at US ports would erode stability in global trade and supply chains. China has vowed to use its big market to help companies cope with “external shocks.” Japan’s ruling Liberal Democratic Party is said to be set to make an emergency proposal in the wake of the US tariffs, urging the government to strengthen loan support for companies and boost domestic demand.

In FX, the Bloomberg Dollar Spot Index slid 0.8% on Monday to a 9 month low, its worst day in 2 weeks. Every Group-of-10 currency gained against the greenback. The jump in the yen weighed on stock indexes in Japan, pushing the Nikkei 225 down 1.3%. The yen, euro and Swiss franc rallied. Brent fell as much as 2% to below $67 a barrel.

In rates, the Treasury yield curve steepened with two-year notes rallying as longer maturities tumbled. That suggests investors are betting on the chance of interest rate cuts and reflecting concerns over long-term US assets. The Treasury curve pivots around a near unchanged 5-year sector, with the twist steepening move widening 2s10s, 5s30s spreads by 6.5bp and 6bp on the day, adding to Thursday’s steepening momentum. US 10-year yields trade around 4.40%, cheaper by 8bp vs. Thursday close. According to Bloomberg, price action continues around a narrative of declining dollar and US stock futures amid continued concerns that President Donald Trump will fire Federal Reserve Chairman Jerome Powell. Added premium for Fed cuts seen in front-end, where swaps now price around 90bp of easing for the year vs. 85bp priced last week. European markets also shut for Easter Monday. Treasury auctions resume Tuesday with $69 billion 2-year notes, followed by $70 billion 5-year and $44 billion 7-year Wednesday and Thursday.

In commodities, oil retreated as traders fretted over the impact of the US-led trade war on energy demand, while sings of progress in talks between Washington and Tehran eased concerns about supplies from Iran. WTI crude traded down 2.4% to $62.50, erasing much of Friday’s gain. Meanwhile gold continues to print record highs, rising above $3400 amid collapsing confidence in fiat currencies.

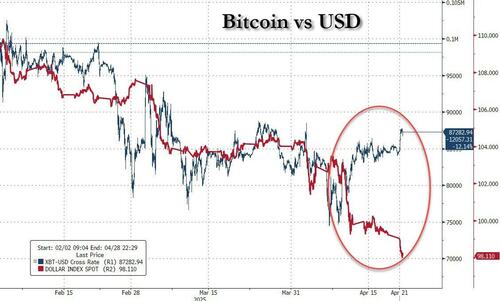

But while gold’s surge was to be expected, the most notable move overnight is that bitcoin finally snapped higher, breaking its recent correlation with the dollar (and inverse correlation with the yen due to its carry trade funding), and surged above $87,000, suggesting a sharp move higher in bitcoin may be imminent, especially once other central banks start easing to offset the collapse in the USD.

US economic calendar includes March Leading index at 10am. This week also includes manufacturing PMI, durable goods orders and University of Michigan sentiment. Fed speaker slate includes Goolsbee at 8:30am. This week also includes Jefferson, Harker, Kashkari, Barkin, Kugler, Musalem, Waller and Hammack

Market Snapshot

- S&P 500 mini -1.1%,

- Nasdaq 100 mini -1.3%,

- Russell 2000 mini -0.9%

- Stoxx Europe 600 -0.1%

- DAX -0.5%

- CAC 40 -0.6%

- 10-year Treasury yield +3 basis points at 4.36%

- VIX +3.2 points at 32.81

- Bloomberg Dollar Index -1% at 1212.42

- euro +1.5% at $1.1566

- WTI crude -2.7% at $62.94/barrel

Top Overnight News

- The dollar slumped on Monday (lowest level since December 2023) as investors responded to mounting uncertainty over US economic policy following Trump’s attacks on Federal Reserve chair Jay Powell. The moves came after Kevin Hassett, director of the National Economic Council, said Trump would “continue to study” the matter of dismissing Powell. The President had claimed on Thurs that he had the right to fire the Fed chair. FT

- Pete Hegseth shared sensitive plans about Yemen strikes in a Signal chat with his wife, brother and personal lawyer, the NYT reported. NYT

- China has warned countries against making trade deals with the U.S. that could hurt China’s interests, in response to news reports that said the Trump administration planned to pressure nations to limit trade with Beijing in exchange for tariff exemptions. WSJ

- China has stopped buying LNG from the US in the latest sign of economic decoupling between the two countries (Chinese purchases have been dwindling for months, but have now come to a complete halt). NYT

- In response to pressure from the Chinese government, Chinese state-backed funds are cutting off new investment in US private equity in the latest salvo against Trump’s trade war. FT

- Ukraine’s Volodymyr Zelenskiy accused Russia of violating a 30-hour truce and reiterated his proposal for an extension. BBG

- South Korea has found increased attempts to disguise foreign products as Korean exports, primarily from China, to avoid U.S. President Donald Trump’s sweeping tariffs, its customs agency said on Monday. The Korea Customs Service said it has found 29.5 billion won ($20.81 million) worth of violations related to country of origin from the first quarter, with U.S.-bound shipments accounting for 97% of the total, after a special probe last month. RTRS

- Japan’s PM Shigeru Ishiba said his country won’t concede to all US demands in levy talks. BBG

- Japan’s ruling party will today propose emergency measures in response to US tariffs, including loan support and boosting demand. The draft proposal criticizes the tariffs as undermining free trade.

US Event Calendar

- 10:00 am: Mar Leading Index, est. -0.5%, prior -0.3%

Central Banks:

- 8:30 am: Fed’s Goolsbee Appears on CNBC

Tyler Durden Mon, 04/21/2025 – 08:25

Source: https://freedombunker.com/2025/04/21/us-stock-futures-dollar-treasuries-tumble-on-powell-punt-panic-gold-bitcoin-soar/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Before It’s News® is a community of individuals who report on what’s going on around them, from all around the world. Anyone can join. Anyone can contribute. Anyone can become informed about their world. "United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

LION'S MANE PRODUCT

Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules

Mushrooms are having a moment. One fabulous fungus in particular, lion’s mane, may help improve memory, depression and anxiety symptoms. They are also an excellent source of nutrients that show promise as a therapy for dementia, and other neurodegenerative diseases. If you’re living with anxiety or depression, you may be curious about all the therapy options out there — including the natural ones.Our Lion’s Mane WHOLE MIND Nootropic Blend has been formulated to utilize the potency of Lion’s mane but also include the benefits of four other Highly Beneficial Mushrooms. Synergistically, they work together to Build your health through improving cognitive function and immunity regardless of your age. Our Nootropic not only improves your Cognitive Function and Activates your Immune System, but it benefits growth of Essential Gut Flora, further enhancing your Vitality.

Our Formula includes: Lion’s Mane Mushrooms which Increase Brain Power through nerve growth, lessen anxiety, reduce depression, and improve concentration. Its an excellent adaptogen, promotes sleep and improves immunity. Shiitake Mushrooms which Fight cancer cells and infectious disease, boost the immune system, promotes brain function, and serves as a source of B vitamins. Maitake Mushrooms which regulate blood sugar levels of diabetics, reduce hypertension and boosts the immune system. Reishi Mushrooms which Fight inflammation, liver disease, fatigue, tumor growth and cancer. They Improve skin disorders and soothes digestive problems, stomach ulcers and leaky gut syndrome. Chaga Mushrooms which have anti-aging effects, boost immune function, improve stamina and athletic performance, even act as a natural aphrodisiac, fighting diabetes and improving liver function. Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules Today. Be 100% Satisfied or Receive a Full Money Back Guarantee. Order Yours Today by Following This Link.