With Microcap Earnings Frenzy Knocking, Here’s What’s Already Caught Our Attention [GeoWire Weekly No. 178]

Welcome to The GeoWire , your source for a Peek into GeoInvesting’s Research Coverage, Microcap Stock Education, Case Studies, Featured Videos, and More. Please share this if you like today’s newsletter and comment with any feedback.

If you are new or this was shared with you, you can join our email list here.

For real time analysis of our coverage universe, including new high conviction ideas and additions to our model portfolios, if you are not already a premium subscriber, consider supporting our movement by becoming a premium member today. GeoInvesting, 16 years and counting!

If you are a premium member make sure you sign in to see All the exclusive content In This Issue.

SIGN IN

Highlights

|

Microcap Earnings Ramping Up

The next two or three weeks are going to be busy with an onslaught of fourth-quarter 2024 microcap earnings reports coming out in bunches. However, last week was still a fairly busy week in the microcap earnings world.

Here are two hot links that will be useful for you to reference as part of our weekly earnings coverage updates. Make sure you bookmark them if you use GeoInvesting to do stock research. Both pages include filters to help you do your research:

Note: Earnings coverage is provided by MS Microcaps NEW information arbitrage press release research tool, soon to be powered by AI. Stay in the loop for updates.

As you know, we also just launched our Buy On Pullback (BOP) Model Portfolio #13, with 9 stocks, shortly before the market closed on Friday, March 7.

I also decided to prepare a video to go over the rationale of why I included these stocks in the BOP, as well as the price targets I set for them. Remember, BOPs are meant to stay open for about 3 to 12 months, so knowing price targets can be important to the success of the strategy. This could help you navigate volatility that occurs in microcap socks.

In addition, in the video, I thought it would be a cool idea to briefly discuss other stocks I was considering to add to the BOP.

One of them happens to be Frequency Electronics, Inc. (NASDAQ:FEIM), which was up 13.80% on Friday, after they reported a home run Q3 2025 earnings report.

Obviously, we wish we would have officially added FEIM to Buy on Pullback Portfolio #13, instead of just making it a runner-up, but the decision not to add it to BOP 13 was due to the fact that the stock was also in BOP #12. So, we just wanted to mix it up a little.

While in BOP #12, FEIM returned 37.95%.

Regardless, with its big focus on satellite communications, FEIM still remains in our select coverage universe model portfolio, which basically takes certain stocks from our 1,500+ microcap coverage universe that we think are worth watching.

Model Portfolio Earnings Report Standouts

Frequency Electronics, Inc. (NASDAQ:FEIM) – Frequency control products to regulate power and accuracy

Frequency Electronics, Inc. (NASDAQ:FEIM) reported much better than expected Q3 2025 report on Thursday, after the market closed. Sales rose to $18.9 million from $13.7 million last year, and non-GAAP EPS hit $0.35, up from a penny. Gross margins at 42% show how far they’ve come from the 20%-30% days. Management’s focus to only go after high margin contracts was a big part of the company’s turnaround plan put in place a couple years ago. It’s good to see that the company has been able to post two back-to-back quarters of gross margins over 40%. We love this stock  .

.

Although management is happy about new wins in satellite programs and quantum sensing, they waved a slight caution flag in their government business, since spending audits under the new administration might push out contract timelines. No cuts yet, just potential delays.

Still, a backlog of $73 million (down from $78M), hints at an annual EPS run-rate of $1.40-$1.80.

Even a reasonable P/E of 15x on the low end of this range implies a price target of $21. (company typically goes through its backlog within about 12 months).

Moving on to the Q3 2025 earnings call, management reiterated its favorable outlook, where the CEO, Thomas McClelland, talked about pursuing significant new business in satellite programs and quantum sensing.

They expect wins in the next few quarters, but the risk is clear: Government funding changes could delay awards, though they see it as a timing hiccup, not a disaster.

Kewaunee Scientific Corporation (NASDAQ:KEQU) – Scientific lab equipment and furniture

We view the 32% pullback in Kewaunee Scientific Corporation (NASDAQ:KEQU) from its highs to be overly egregious.

Even though we just added Kewaunee Scientific Corporation (NASDAQ:KEQU) to our Buy On Pullback (BOP) Model Portfolio #13, it has been in our Open Forum Model Portfolio since February 25, 2025.

Our Open Forum Model Portfolio selections are favorite stocks from our 1,500+ microcap coverage universe. It basically challenges our team to come up with one favorite stock every month that we discuss in our live monthly forum events. These events take place at the beginning of each month to go over our entire coverage universe. We won’t always be right with our timing, but this practice helps us stay sharp with what’s going on in our coverage universe.

KEQU reported their Q3 2025 results after Thursday’s close and they were interesting.. Sales rose 44% to $67.1 million, thanks mostly to the recently closed Nu Aire acquisition, so we are still waiting for the company to grow its revenue organically. Adjusted EPS rose 28% to $1.09.

Now, at first glance, you might not be impressed with the numbers, because EPS was sequentially down from Q2 2024 EPS results of $1.41. You might have expected EPS to be sequentially higher due to the third quarter having a full contribution from the Nu Aire acquisition that was completed on November 1, 2024. Even though sales were sequentially higher, EPS was sequentially lower, as operating expenses as a percent of sales were higher (~20% versus ~18%). It’s something we’re going to talk to management about, but we’re not too worried.

Backlog is the real story, $222 million, up from $184.4 million in Q2 2025. We believe the sales growth that’s about to occur will absorb extra operating expenses that came with the Nu Aire acquisition. There is a significant amount of sales velocity that could occur from selling Nu Aire’s more modern products into KEQU Legacy customer base. For those investing newbies, the fancy phrase for this is “wallet share gains.”

KEQU Will also see an extra boost its sales in India start ramping up:

“In India, where our backlog is at a record high, revenue has been slowed due to construction site delays. We are working closely with our customers to ensure seamless execution when project sites are ready. This will result in favorable revenue and earnings for us.”

Separately, KEQU added 100,000 shares to their repurchase program. With an EPS run-rate over $5 (P/E near 10x), we think investors are under-appreciating KEQU’s turnaround success and clear leadership position in its industry.

We actually published an updated research article to what we originally published to GeoInvesting on behalf of MS Cliff Notes, on February 27, 2025.

Bird Construction Inc. (OOTC:BIRDF) (BDT.TO) – Leading construction company in Canada

Full-year sales at $3.4 billion CAD, EPS at $2.04. Q4’s 41% EPS jump keeps it a Contributor Index fave.

Bird Construction’s full-year revenue hit $3.4 billion CAD, up 18% from 2023, with Q4 revenue at $936.7 million, up 18.25%. Backlog is also looking really good:

“Bird’s Backlog was $3.7 billion at December 31, 2024, with $862.4 million of securements in the fourth quarter ($3.7 billion year-to-date). Pending Backlog, which is work awarded but not yet contracted, was $3.9 billion at year-end and continues to include almost $900 million of master service agreement (“MSA”) and other recurring revenue to be earned over the next six years.”

BIRD has a clear playbook: leverage a fat backlog, integrate acquisitions, and stick to high-margin / low-risk contracts.

The model is evolving from a traditional contractor to a strategic partner, which we believe could justify a premium valuation. The company currently resides in our Select Coverage Universe Model Portfolio and our high performing Infrastructure Screen.

“Diversification” and “collaborative contracts” were key strategies to setting 2025-2027 targets of 10% organic revenue growth (±2%) and an 8% EBITDA margin by 2027 (vs. 6.3%, currently), with 33% of net income returning to shareholders via dividends.

Bird’s new growth path is leaning hard into collaborative contracts (e.g., alliances with partners on projects), reducing risk exposure and is moving forward with a more diversified sector backlog

Basically, BIRD is not chasing volume at the sacrifice of profitability.

Champions Oncology, Inc. (NASDAQ:CSBR) – Research services to pharma and biotech companies.

***Important*** Please make sure you read the Earnings Call transcript, where I try to drill into the company’s new high margin, data licensing business model.

CSBR’s Q3 2025 revenue hit a record $17 million (up from $12M in Q3 2024), driven by a $5 million data licensing deal—the first of its kind for the company. Core pharma research services rose slightly to $12.5 million, with gross margins at 48% vs. 35% last year. Non-GAAP EPS came in at $0.33 vs. a loss of $0.16 in the prior year.

The “early traction” in data licensing model that we broke aligns with CSBR betting on a high-margin, scalable revenue stream to layer atop its slower growing legacy biotech research services business.

Please be aware that not all data licensing agreements will be large and it’s probably going to take time for investors to believe that the company can continue to close more of these types of data licensing contracts on a consistent basis.

Until then, it will be a tug-of-war between those who believe this will happen vs. impatient investors who don’t want to wait around to find out.

These kinds of decisions are what make investing hard.

But the opportunity is clear. These pure margin types of contracts could transform the company and turn the stock into a quick multi-bagger, as soon as a few more deals are announced.

The earnings call talked about the company’s data bank being the backbone of biopharma studies and that with AI extracting deeper insights, demand for its dataset is spiking.

The company has 400-500 current pharma clients to market its data licensing services too, so the pool is huge. More importantly, many of these customers are actually coming to the company to inquire about the service. Three or four deals a year could shift the valuation of the stock higher, by multiples.

Other Earnings Worth Mentioning

Hf Foods Group Inc. (NASDAQ:HFFG) – Food products to Asian style restaurants

Q4 2024 Sales were $305.3 million (up from $280.9M), EPS rose 120% to $0.11 beating estimates of $0.09. We have not really followed this company much in the past, but the company is selling at a meager P/E of 8.4x on 2024 EPS of $0.26. The one analyst estimate out there has them doing EPS of $0.46 in 2025 and $0.60 in 2026.

We need to find out why the stock is selling at such a depressed P/E ratio. Usually when this occurs, there are hidden risks to diagnose. The current debt position of the company might be the culprit. Our job will be to see if we believe the company can reduce its debt levels without destroying capital structure.

We also need to examine the company’s adjusted EPS calculations to see if they are too aggressive or actually in line with how we would make adjustments. See our article on the subject.

The company is:

“…a leading marketer and distributor of fresh produce, frozen and dry food, and non-food products to primarily Asian restaurants and other foodservice customers throughout the United States. HF Foods aims to supply the increasing demand for Asian American restaurant cuisine, leveraging its nationwide network of distribution centers and its strong relations with growers and suppliers of fresh, high-quality specialty restaurant food products and supplies in the US and Asia. Headquartered in Las Vegas, Nevada.”

Kingstone Companies, Inc (NASDAQ:KINS) – Property and casually insurance

Q4 2024 EPS of $0.46 topped $0.42 forecasts, with revenue at $35.9 million. Kudos to GeoInvesting subscriber, Scott Weiss of Semco Capital, for pounding the table that I should have started following KINS when it was much lower. Unfortunately, we never pulled the trigger, only briefly highlighting during the earnings portion of our August 2024 Open Forum (1:23:33) as a company that was brought to our attention by Scott.

My primary hesitation with KINS stemmed from the broader risks and unpredictability of the property insurance sector, which I tend to stay away from. It appears I should have heeded Scott’s hints of great things to come.

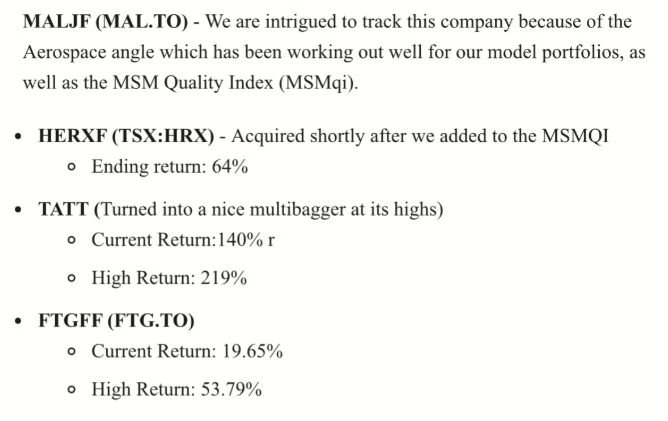

Magellan Aerospace Corporation (OOTC:MALJF) (MAL.TO) – Aerospace equipment

Q4 2024 EPS hit $0.28 (from zero), with sales increasing to $240.7 million vs. $223 million. The aerospace theme has us intrigued, due to our success in highlighting other aerospace stocks in GeoInvesting that have had multibagger moves.

GeoInvesting morning email excerpt:

Dud Of The Week:

Dud Of The Week:

Optical Cable Corporation (NASDAQ:OCC) – Fiberoptic cable and copper wire solutions

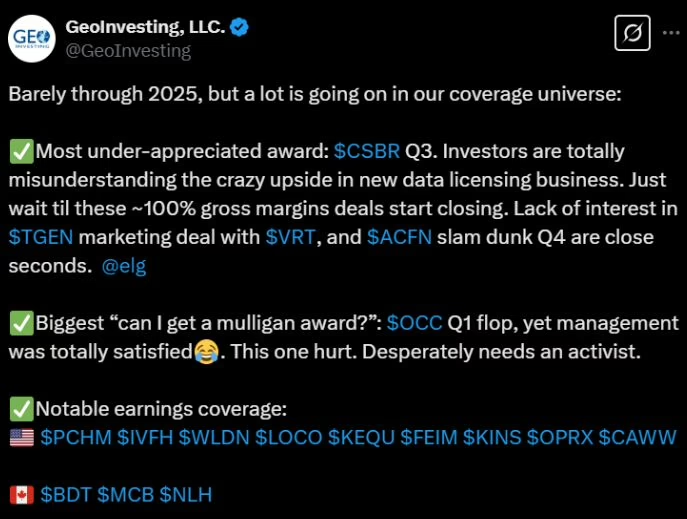

All you need to do to know about how I feel about OCC bad quarter, where it lost money on a dismal sales performance after making glowing comments during its Q4 2024 press release and earnings call when it should have known what Q1 2025 looked like… is in this tweet:

You be the judge. Here is a link to the 2024 shareholder letter, where management talks about the bottoming of the negative industry trends that have plagued it over the past 18 months and the “incredible” operating leverage the company has.

Note to company in order to experience operating leverage, you have to grow your freaking sales!

in order to experience operating leverage, you have to grow your freaking sales!

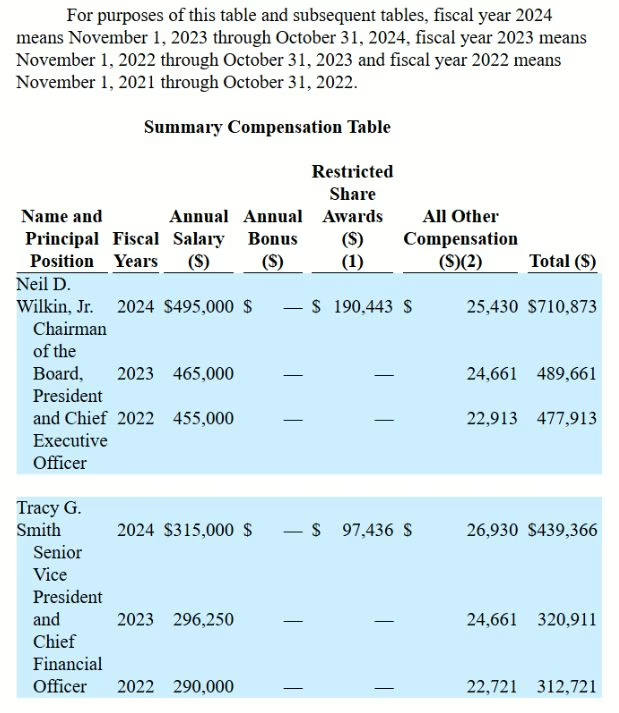

I’m beginning to think that this company is running a lifestyle company, where the CEO and CFO made a combined salary of around $1.2 million in 2024, of which $810,000 was base salary. (Source: Proxy Filing).

Not bad for a company that has posted minimal growth for years and limited profits, but basically calls itself a leader in the industry.

Furthermore, how the heck has this company not been chasing data center opportunities from its data center based subsidiary in Dallas, Texas?

“It hasn’t been a huge part of our business to-date, but it is something that we do have some regular business in.”

Hello! Tss, Inc. (NASDAQ:TSSI) is in Austin, Texas. You might want to pick up the phone and give them a call because they do integration work, which requires cabling solutions!

Focusing on this area of greenfields may somewhat counter the effects of the cyclicality that is present in other parts of its business which seems to be the excuse management uses to justify its lackluster past performance.

You also might want to pick up the phone when I give you a call or return my calls to have a discussion about this and stop limiting live question and answer sessions to analysts on your Earnings Calls. All right, Mr. Nvidia Corporation (NASDAQ:NVDA). Seriously? What analysts are following you right now?

~ Maj Soueidan, Co-founder, GeoInvesting

Buy on Pullback Model Portfolio and MS Microcaps’ Virtual Conference Replays Now Available.

gain Exposure to our expanded coverage on Our 1500+ Microcap Universe, Subscribe below.

Please don’t forget to consider supporting GeoInvesting with a premium subscription if you enjoyed this content, and want to see more of it. Complete this short survey to let us know you’re engaged and interested.

200+ multibaggers and counting

GeoInvesting is a premier research platform for microcap investors, dedicated to uncovering high-potential stock ideas in undervalued companies across various sectors. With over 30 years of investing experience, GeoInvesting has covered more than 1,500 equities, providing often actionable proprietary research. The platform has been instrumental in identifying 200+ multibagger stocks, and offers investors exclusive access to over 600 management interview clips, allowing for deeper due diligence and understanding of the microcap stocks, many of which make it to market-beating premium Model Portfolios. Join the GeoInvesting community for the best stock research and microcap insights to help you stay ahead in the market. To learn more about our Premium Services, go here.. (https://geoinvesting.com/premium-research/)

The post With Microcap Earnings Frenzy Knocking, Here’s What’s Already Caught Our Attention [GeoWire Weekly No. 178] appeared first on GeoInvesting.

Source: https://geoinvesting.com/with-microcap-earnings-frenzy-knocking-lets-take-look-at-whats-already-caught-our-attention/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Before It’s News® is a community of individuals who report on what’s going on around them, from all around the world. Anyone can join. Anyone can contribute. Anyone can become informed about their world. "United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

LION'S MANE PRODUCT

Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules

Mushrooms are having a moment. One fabulous fungus in particular, lion’s mane, may help improve memory, depression and anxiety symptoms. They are also an excellent source of nutrients that show promise as a therapy for dementia, and other neurodegenerative diseases. If you’re living with anxiety or depression, you may be curious about all the therapy options out there — including the natural ones.Our Lion’s Mane WHOLE MIND Nootropic Blend has been formulated to utilize the potency of Lion’s mane but also include the benefits of four other Highly Beneficial Mushrooms. Synergistically, they work together to Build your health through improving cognitive function and immunity regardless of your age. Our Nootropic not only improves your Cognitive Function and Activates your Immune System, but it benefits growth of Essential Gut Flora, further enhancing your Vitality.

Our Formula includes: Lion’s Mane Mushrooms which Increase Brain Power through nerve growth, lessen anxiety, reduce depression, and improve concentration. Its an excellent adaptogen, promotes sleep and improves immunity. Shiitake Mushrooms which Fight cancer cells and infectious disease, boost the immune system, promotes brain function, and serves as a source of B vitamins. Maitake Mushrooms which regulate blood sugar levels of diabetics, reduce hypertension and boosts the immune system. Reishi Mushrooms which Fight inflammation, liver disease, fatigue, tumor growth and cancer. They Improve skin disorders and soothes digestive problems, stomach ulcers and leaky gut syndrome. Chaga Mushrooms which have anti-aging effects, boost immune function, improve stamina and athletic performance, even act as a natural aphrodisiac, fighting diabetes and improving liver function. Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules Today. Be 100% Satisfied or Receive a Full Money Back Guarantee. Order Yours Today by Following This Link.