Embargoes: The Flip Side of Trump’s China Tariffs

This post Embargoes: The Flip Side of Trump’s China Tariffs appeared first on Daily Reckoning.

Happy April 15th. Remember to file your tax return, or else file for an extension. (Okay, that’s my public service announcement for the day.) And welcome to many new subscribers who have joined us in recent weeks. Now, on to business.

This note pertains to President Trump’s tariff schedules; or rather, his on-again, off-again tariff schedules. They come, they go. They get put in place, the stock market tanks, and then they’re deferred for three months. Or perhaps we’ll work out deals with a long list of very annoyed foreign countries, and tariffs will go down. Frankly, at this stage nobody knows.

Presently, we have baseline U.S. tariffs of 10% on pretty much everything. Plus, 25% tariffs on imported steel, aluminum and some cars. Over and above this, Trump imposed historically high tariffs on key trade partners like Europe, Japan, South Korea and countries in Latin and South America. And huge tariffs on China, which retaliated with its own huge tariffs on U.S. goods.

But there’s a flip side to huge tariffs, especially those on China; namely, retaliatory embargoes.

Looking ahead, prepare to be astonished at the deep impact Chinese embargoes will have on life in America, from basic industry to consumer products you might buy down at the big box store, and definitely on national defense.

Spoiler alert: Chinese embargoes are a bad situation and will disrupt the U.S. economy while creating upside investment opportunities along the way.

China’s Critical Mineral Control

Here’s the basic point to know: China has banned exports of certain critical minerals, elements and related materials to the U.S., both generally to third party buyers and specifically to a long list of U.S. companies.

In other words, you might still be able to buy a few pounds of this or that from some Chinese seller on eBay, but China has cut off industrial-scale sales to U.S. buyers, specifically to defense contractors like Lockheed, Raytheon, Northrop Grumman, Boeing and many more.

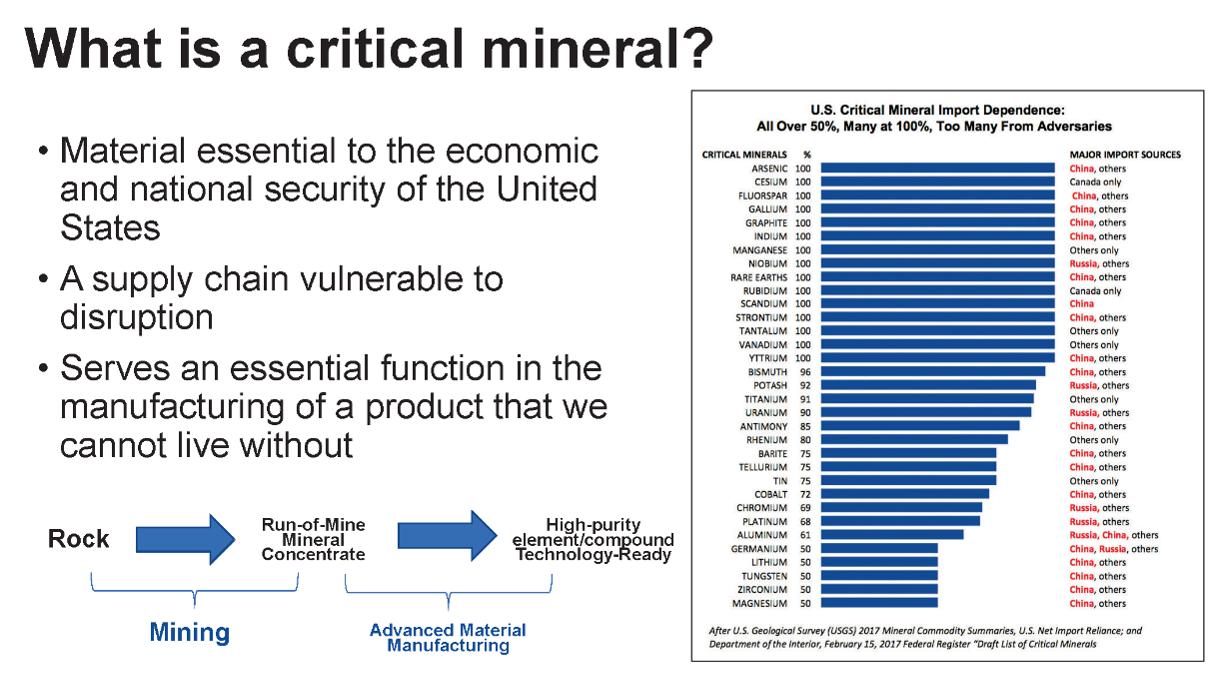

Meanwhile, the U.S. produces zero, or at best minimal amounts of many of these critical items, and China produces lots of them, if not dominates global production. Here’s a chart to help illustrate the point:

Courtesy U.S. Critical Minerals.

Look at that long list of items, and the overall high degree of U.S. import dependency, especially on China. This is not some new situation that Trump created in the past three months. No, it’s more like a long-term, half century unwind of U.S. industrial capabilities, with innumerable reasons behind it all. Let’s look at some examples.

Perhaps you’ve heard of “rare earths” which are a set of 17 elements in the periodic table. Lately, they are in the news because you’ll find them alloyed into components of everything from your smart phone to the car in your driveway, and much else such as F-35s and Virginia class submarines.

Rare earths elements (REEs) have unique properties of magnetism, phosphorescence, electronic behavior and more. More than likely, you didn’t study them in high school chemistry class because they are so exotic. But guess what: they’re now on the chemistry test of life because modern technology cannot work without them. I’ll explain more in a moment.

Or perhaps you’ve heard of elements like gallium, germanium, tungsten, indium, bismuth, tin, antimony, or a form of carbon called graphite. Again, you may never have had reason to learn too much about them, but I assure you that the world can’t function for long absent these materials.

The world at large requires these substances, and the geopolitical-industrial fact is that China dominates global output, as is evident from the chart above.

For other elements like REEs, Chinese production is well over 85% of annual world total. For gallium, germanium, bismuth and graphite the China number is up around 80%.

Okay, so maybe you think that if China cuts off the U.S. from these substances, American industry can procure alternative sources from some other country, even though that nation may only produce small amount, right?

Well, no. Because for many materials of which China is the Number One producer, the second place slot is held by, say, Russia. And for some materials, third place is held by North Korea. Or perhaps Kazakhstan or Vietnam.

You see the problem here, right? If China cuts off American users, alternative supplies can only be sourced from other nations that are not exactly friendly to the U.S., or they’re far away and distance alone creates its own issues.

How Rare are ‘Rare’ Minerals?

Now, on to the next question: do we have REEs, tungsten, antimony, indium, gallium, etc. here in the U.S., if not North America? Because after all, the idea behind Trump’s tariffs is to raise protective barriers and encourage U.S. producers to get into the business of making and selling things here in the U.S.

Zinc bearing sphalerite, enriched also in indium. From a deposit in Kansas. BWK collection.

And the good news is that yes, these critical elements are present in American rocks. But the bad news is that mining said rocks, let alone processing it all into usable end products, requires industries and supply chains that the U.S. lacks, which includes people with skills to make it all work. Indeed, just to build a new mine in the U.S. requires a decade and more.

Again, the root of the supply chain problem isn’t Trump or tariffs. And no, Trump didn’t just awaken one day and decide to rebuild the U.S. mining industry. Many people have known about the problems for decades.

At a personal level, on my end I studied REEs and other exotic metals almost 50 years ago when I was in college, majoring in geology. I’ve banged a drum on the matter for many years, but to use a mixed analogy of geology and Greek, it was a Sisyphean effort, pushing a big rock up a hill.

At higher levels, the long-gone U.S. Bureau of Mines (closed under President Clinton in the 1990s, sad to say) worried about such things. While in more recent times the U.S. Geological Survey has published library shelves full of papers and books on the topic.

But the deeper question is, why does China dominate production of critical metals and materials, while the U.S. is so far behind? Well, because back in the 1980s China’s political system – the Chinese Communist Party – made a long-term national commitment to develop primary metal industries in that country.

In fact, the late Chinese leader Deng Xiaoping (1904 – 1997) once quipped that “Saudi Arabia has much oil, and China has large deposits of rare earths. China must become the Saudi Arabia of rare earths.”

In short, China focused industrial policy on building out its metals industries, REEs and much else. China focused on everything from primary steel and aluminum, to copper, lead, zinc, and any other element they could pull from mineral ores and cast into ingots at the refinery. Which includes REEs, tungsten, antimony, gallium, tin, etc.

Chinese cassiterite, source of tin. BWK collection.

Over time, China became so proficient in metallurgy that its vast array of companies set super-low-price points which drove Western competitors out of business. For example, the U.S. led the world in REE production from the 1950s into the 1980s; your old RCA Victor television set had bright red colors due to europium mined in California.

But by the 1990s, Chinese mining and refining had kicked into gear and began to dominate world REE output. As recently as 2010, Chinese REE output was about 96% of world total. Today it’s still in the 85% range.

I could tell a similar story about China’s rise to dominate production of, say, tungsten which is used in machine tools, drill bits, military grade ammunition and much else.

Chinese scheelite, source of tungsten. BWK collection.

Or there’s Chinese dominance in antimony, used in fire suppression materials, and a key component in ammunition primers. That is, antimony is critical to manufacture everything from pistol and rifle rounds up to artillery, bombs, and even missile rocket motors.

Consider gallium, which comes from refining bauxite into primary aluminum (and no, there’s no gallium in recycled beer cans, you need ore from the earth). It’s used extensively in electronic circuitry and even has medical applications. And China is big into gallium.

Other metals like germanium and indium are critical to manufacturing semiconductors and electronic solder. Mostly, these metals come from refining zinc ore, namely a mineral called sphalerite (see photo above). These atoms tend to find a home in the sphalerite crystal structure and require advanced metallurgical techniques to recover. The point being that China refines lots of zinc, hence controls world output of these metals.

Alternate Supplies

We could discuss these metallurgical angles all day, and I write about the issues in other newsletters like Strategic Intelligence and Lifetime Income Report. But for now, the takeaway is that Trump’s tariffs have been met with Chinese embargoes on substances which they control and dominate in terms of world output.

This new embargo regime will – no question – squeeze U.S. industries. Purchasing managers now must scramble to find alternate supplies, perhaps from other nations or in more underground and roundabout methods to obtain product from China. Prices will rise, and shortages will become commonplace.

Yes, we have tariff-induced investment opportunities in U.S. and other Western plays that promise to rebuild industrial supply chains. These range from big mining names like Rio Tinto and BHP to intermediate-sized companies and small developers in the U.S. and Canada.

But bear in mind that developing new mines, mills and refineries requires time; many years, even when things go well, and project schedules that range out to a decade and more.

Also, we face a deep shortage of human skills in these niche industrial sectors. American universities long ago throttled back on educating future geologists, mineralogists, mining and chemical engineers, metallurgists, and many other skillsets.

If it all sounds grim, that’s because it’s grim. But again, there are opportunities as well. And there’s much more to say about Trump, tariffs and retaliatory embargoes, but I’ll end here and promise more to come in future reports.

The post Embargoes: The Flip Side of Trump’s China Tariffs appeared first on Daily Reckoning.

This story originally appeared in the Daily Reckoning

Source: https://dailyreckoning.com/embargoes-the-flip-side-of-trumps-china-tariffs/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Before It’s News® is a community of individuals who report on what’s going on around them, from all around the world. Anyone can join. Anyone can contribute. Anyone can become informed about their world. "United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

LION'S MANE PRODUCT

Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules

Mushrooms are having a moment. One fabulous fungus in particular, lion’s mane, may help improve memory, depression and anxiety symptoms. They are also an excellent source of nutrients that show promise as a therapy for dementia, and other neurodegenerative diseases. If you’re living with anxiety or depression, you may be curious about all the therapy options out there — including the natural ones.Our Lion’s Mane WHOLE MIND Nootropic Blend has been formulated to utilize the potency of Lion’s mane but also include the benefits of four other Highly Beneficial Mushrooms. Synergistically, they work together to Build your health through improving cognitive function and immunity regardless of your age. Our Nootropic not only improves your Cognitive Function and Activates your Immune System, but it benefits growth of Essential Gut Flora, further enhancing your Vitality.

Our Formula includes: Lion’s Mane Mushrooms which Increase Brain Power through nerve growth, lessen anxiety, reduce depression, and improve concentration. Its an excellent adaptogen, promotes sleep and improves immunity. Shiitake Mushrooms which Fight cancer cells and infectious disease, boost the immune system, promotes brain function, and serves as a source of B vitamins. Maitake Mushrooms which regulate blood sugar levels of diabetics, reduce hypertension and boosts the immune system. Reishi Mushrooms which Fight inflammation, liver disease, fatigue, tumor growth and cancer. They Improve skin disorders and soothes digestive problems, stomach ulcers and leaky gut syndrome. Chaga Mushrooms which have anti-aging effects, boost immune function, improve stamina and athletic performance, even act as a natural aphrodisiac, fighting diabetes and improving liver function. Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules Today. Be 100% Satisfied or Receive a Full Money Back Guarantee. Order Yours Today by Following This Link.