More People Buying Groceries With Buy Now Pay Later – Late Payments Rising

In yet another sign of a cracking and creaking US economy, Americans are increasingly tapping Buy Now, Pay Later (BNPL) financing to pay for daily essentials — even groceries – according to a new survey released Friday by Lending Tree.

“A lot of people are struggling and looking for ways to extend their budget,” said Lending Tree chief consumer analyst Matt Schulz. “Inflation is still a problem. Interest rates are still really high. There’s a lot of uncertainty around tariffs and other economic issues, and it’s all going to add up to a lot of people looking for ways to extend their budget however they can.”

There are plenty of concerning findings in the survey. For starters, there’s the rising share of BNPL users who are buying now and paying late — 41% say they were tardy over the past year, which is up from 34% in last year’s survey. About three-quarters of the late-payers say they were late by no more than “a week or so.” However, where that and other numbers are concerned, it’s important to note that these stats are based on survey responses — not the hard data of their BNPL providers. Given human nature, it’s reasonable to think respondents would understate subpar behavior.

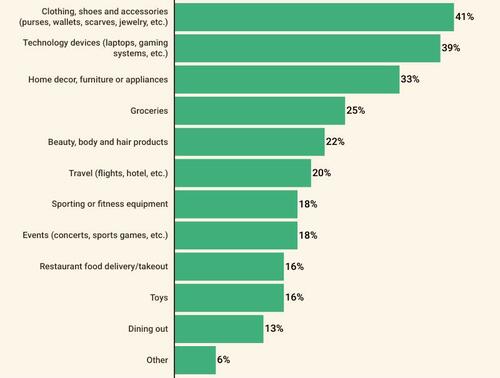

The top two categories of BNPL purchases are clothing, shoes and accessories (41% of BNPL users) followed by technology devices (39%). However, there’s been a surge in people who’ve used BNPL for groceries — 25% versus 14% last year. A whopping one-third of Gen Z BNPL-tappers say they’ve used the financing for groceries. Similarly, 16% of users have tapped BNPL for food delivery or takeout.

That finding comes on the heels of our March report on DoorDash signing a deal with BNPL-facilitator Klarna, to let cash-strapped consumers pay for restaurant food, groceries and other delivery orders in four equal, interest-free installments, or “at a more convenient time, such as a date that aligns with their paycheck schedules.”

So then they securitized all the DoorDash loans and sliced them into tranches to sell off to the banks

Rating agencies were slapping AAA on Chick-fil-A orders for credit scores under 500 who didn’t leave a tip pic.twitter.com/sa3YKIqLhw

— Max Gagliardi (@max_gagliardi) March 21, 2025

Regret is a common feeling among BNPL users: 48% say they’ve regretted using the service on at least one purchase, while 16% say they’ve felt that way multiples times. The emotion is most common among Gen Z: 64% have rued making a BNPL decision, and 24% felt that way about more than one purchase.

Timely payments on BNPL don’t help your credit score, but 62% of users wrongly think they can bolster their scores by using the service and sticking to due dates. Looking forward, Lending Tree says “it’s only a matter of time” until America’s top two credit-scoring firms, FICO and VantageScore, factor BNPL performance into their calculations.

Other findings:

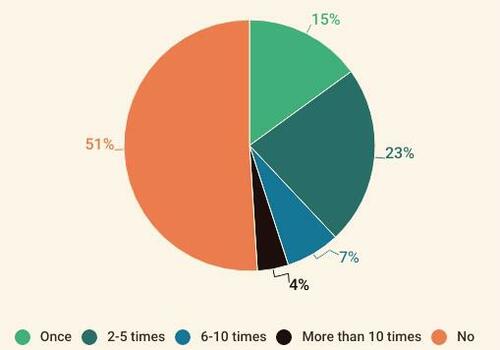

- Nearly half of the respondents have used a BNPL loan, with 11% saying they’ve used them 6 or more times. 23% have had three or more of them running simultaneously.

- 53% of men have used BNPL, versus 46% of female respondents.

- 64% of Gen Zers (age 18 to 28) have used BNPL, compared to 29% of Boomers (61 to 79)

You can add the Lending Tree survey to the tall stack of evidence we recently shared, making the case that the US consumer is melting down.

Psst… click here for a preview of our new partnership at ZH Store.

Tyler Durden Sun, 04/27/2025 – 12:15

Source: https://freedombunker.com/2025/04/27/more-people-buying-groceries-with-buy-now-pay-later-late-payments-rising/

Anyone can join.

Anyone can contribute.

Anyone can become informed about their world.

"United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

Before It’s News® is a community of individuals who report on what’s going on around them, from all around the world. Anyone can join. Anyone can contribute. Anyone can become informed about their world. "United We Stand" Click Here To Create Your Personal Citizen Journalist Account Today, Be Sure To Invite Your Friends.

LION'S MANE PRODUCT

Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules

Mushrooms are having a moment. One fabulous fungus in particular, lion’s mane, may help improve memory, depression and anxiety symptoms. They are also an excellent source of nutrients that show promise as a therapy for dementia, and other neurodegenerative diseases. If you’re living with anxiety or depression, you may be curious about all the therapy options out there — including the natural ones.Our Lion’s Mane WHOLE MIND Nootropic Blend has been formulated to utilize the potency of Lion’s mane but also include the benefits of four other Highly Beneficial Mushrooms. Synergistically, they work together to Build your health through improving cognitive function and immunity regardless of your age. Our Nootropic not only improves your Cognitive Function and Activates your Immune System, but it benefits growth of Essential Gut Flora, further enhancing your Vitality.

Our Formula includes: Lion’s Mane Mushrooms which Increase Brain Power through nerve growth, lessen anxiety, reduce depression, and improve concentration. Its an excellent adaptogen, promotes sleep and improves immunity. Shiitake Mushrooms which Fight cancer cells and infectious disease, boost the immune system, promotes brain function, and serves as a source of B vitamins. Maitake Mushrooms which regulate blood sugar levels of diabetics, reduce hypertension and boosts the immune system. Reishi Mushrooms which Fight inflammation, liver disease, fatigue, tumor growth and cancer. They Improve skin disorders and soothes digestive problems, stomach ulcers and leaky gut syndrome. Chaga Mushrooms which have anti-aging effects, boost immune function, improve stamina and athletic performance, even act as a natural aphrodisiac, fighting diabetes and improving liver function. Try Our Lion’s Mane WHOLE MIND Nootropic Blend 60 Capsules Today. Be 100% Satisfied or Receive a Full Money Back Guarantee. Order Yours Today by Following This Link.